-

Gross profit rose 33% to US$7.65 billion and EBIT pre-special items surged 48% to US$3.7 billion

-

DSV’s three divisions performed well but took a hit from macroeconomic slowdown and freight rate decline

-

With DKK22.88 billion adjusted free cashflow, DSV launched a DKK20.32 billion share buyback and distributed a DKK1.00 per share dividend

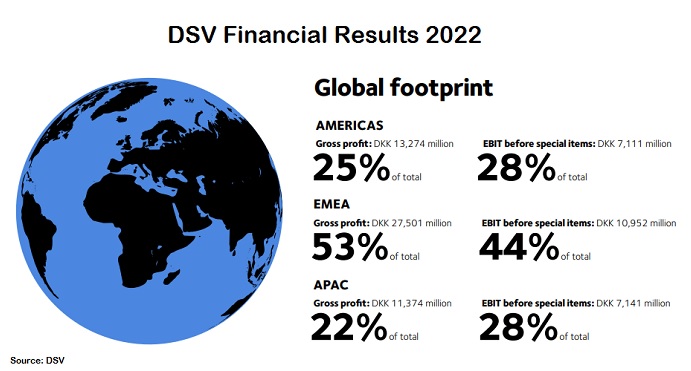

Denmark’s DSV delivered strong results for 2022, driven by group-wide good performance that lifted gross profit 33% to DKK52.15 billion (US$7.65 billion) and EBIT before special items by 48% to DKK25.2 billion ($3.7 billion), more than doubling its adjusted free cash flow.

The group released its final results for 2022 on February 2, acknowledging that all its three divisions that performed robustly earlier in the year were impacted by the general macroeconomic slowdown and the gradual normalization of freight markets.

“2022 was an eventful year, and I know that our teams have worked hard to support our customers as they navigated extremely volatile freight markets and geopolitical unrest,” said group chief executive Jens Bjørn Andersen.

RELATED READ: Soft demand triggers air cargo slump

DSV’s Air & Sea division produced a 53% expansion in EBIT (earnings before interest, tax and depreciation) before special items to DKK20.66 billion, contributing a lion’s share to group profit as seafreight rates that had risen to historic highs in 2021 continued in 2022 on strong demand for Asian goods and port congestion in the West. Adjusted net profit was DKK18.75 billion.

Many shippers turned off by high ocean shipping rates and supply chain disruptions opted for more costly airfreight, putting pressure on air cargo operators to increase rates.

Solutions’ EBIT surged 47.4% to DKK2.7 billion, and Road’s EBIT rose 9.2% to DKK2.04 billion. Towards the end of 2022, the performance of DSV’s three divisions eased as demand slowed, continuing a rate decline that began early in 2022.

With an adjusted free cash flow of DKK22.88 billion, the group launched a DKK20.32 billion share buyback and distributed a dividend of DKK1.00 per share for a total of DKK1.32 billion. That left cash flow for the year of DKK1.64 billion.

“Towards the end of the year, our performance was impacted by the general macroeconomic slowdown and a gradual normalization of the freight markets. We expect this trend will continue into 2023 and this is reflected in our financial guidance,” said Andersen.

RELATED READ: Air cargo revenues set to moderate in 2023

DSV successfully completed the integration of Agility GIL within a year of the acquisition, making the company a top three player in the freight forwarding industry.

The global transport and logistics company said mergers and acquisitions remain an important part of its strategy, and that it continues to monitor the market in search of value-creation opportunities.

For 2023, the group expects EBIT before special items of DKK16-18 billion, and estimates the effective tax rate at 24%. DSV said the 2023 outlook assumes a global economic growth of 2-3% in 2023 – the lowest growth rates in the advanced economies.

RELATED READ: COVID-19 spurs air cargo glut, higher rates

“Normally, DSV would expect transport volumes to grow in line with the economy, but in the second half of 2022, volumes declined more than GDP due to reduction of inventory levels and normalization of consumer behavior after COVID-19,” the company said.

“DSV expects this negative development in freight volumes to continue in the first part of 2023, but with a recovery in the second half of the year.”

DSV, one of the world’s top three freight forwarders, has raised its ambitions and committed to reach net-zero carbon emissions across its operations by 2050. The company said that while geopolitical and macroeconomic uncertainty persist, it will continue to focus on customer service and adapt to changing market conditions.