-

Strong spikes in container rates were seen in the past week, prompting speculation prices may be about to rebound as shippers react to higher prices set in mid-April

-

Drewry says the anticipated arrival of newbuilt capacity will pose a real challenge to carriers managing capacity and maintaining current spot rates

-

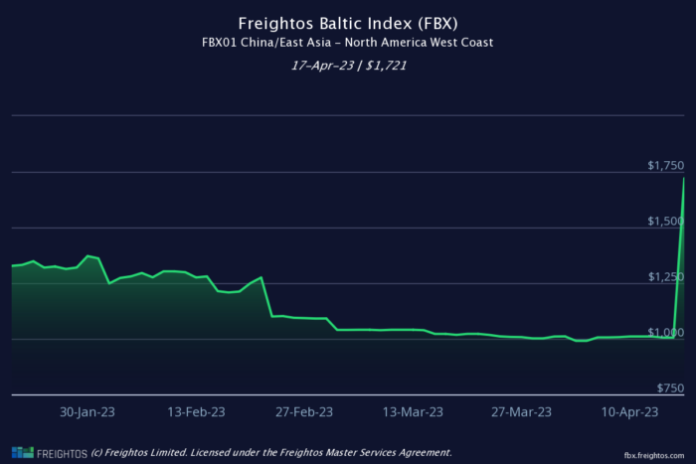

Drewry’s WCI composite index rose 4% with Shanghai-NY up 12% and Shanghai-LA up 11%. Freightos Baltic Index rose 70% on the transpacific US West Coast lane

This past week’s shipping rates rise after higher prices announced by carriers in mid-April appears to signal a recovery from a steady decline since January, prompting speculation prices may have hit the floor.

However, analysts are wary the current spike may be a dead-cat bounce as new vessels joining the global fleet in the coming months add to the existing capacity glut created by weak demand.

“Considering the anticipated arrival of newbuilt capacity, carriers face a real challenge managing capacity and maintaining current spot rates,” said Drewry Supply Chain Advisors in a new update on scheduled sailings in which a further 57 cancellations were announced for the next five weeks.

Drewry’s composite World Container Index increased 4% to $1,773.58 per forty-foot container (FEU) last week, but is 77% lower than the same week in 2022, the online trading and analytics platform said on April 20.

The latest Drewry WCI composite index is now 83% below the peak of $10,377 reached in September 2021. It is 34% lower than the 10-year average of $2,688, indicating a return to more normal prices, but remains 25% higher than average 2019 pre-pandemic rates of $1,420.

Freightos similarly reported a strong spike in the past week to April 19. It said transpacific eastbound rates rose, reflecting the general rate increases (GRI) implemented by carriers from mid-April.

In the latest twist, daily rates so far this past week climbed sharply with US West Coast prices up 70% to $1,721/FEU, higher by 10% than the 2019 levels. US East Coast rates have risen to $2,537/FEU, just 5% below their 2019 level.

“These spikes are the results of several carriers announcing mid-month GRI following some recent increase in import volumes – more to the West Coast than to the East Coast, possibly due to shippers lured by rock-bottom West Coast spot prices – and expectations/hopes for a gradual rebound in demand up through the peak season,” said Freightos head of research Judah Levine.

Levine said the rate hike is probably mostly due to more aggressive carrier capacity reductions through blanked sailings and service suspensions, leading to more ships sailing at or near capacity – a trend on the Asia-Europe lane as well.

RELATED READ: FE-USWC rates-fall faster than SEA-US

As of April 21, transpacific, transatlantic and Asia-North Europe & Mediterranean carriers have cancelled 57 sailings across the major East-West headhaul trades, Drewry said. A week before, they cancelled 62 sailings.

The latest cancellations will be for weeks 17 (April 24-April 30) and week 21 (May 22-May 28) and represent 8% of a total of 675 scheduled sailings. Of the blank sailings, 51% will be on the transpacific eastbound, 42% on Asia-North Europe and Med, and 7% on the transatlantic westbound trade.

Over the next five weeks, THE Alliance has announced 23 cancellations, followed by OCEAN Alliance and 2M with 7. During the same period, 8 blank sailings have been scheduled in non-Alliance services.

Despite the significant decrease in demand that until recently led to low load factors on major East-West headhaul routes, ocean carriers have managed to increase spot rates.

“Currently, carriers have raised or stabilized spot rates on major East-West headhaul routes from Asia, but spot rates for transatlantic westbound trade are still decreasing,” Drewry said.

Freight rates on Drewry’s WCI Shanghai-New York gained 12% or $297 to $2,849/FEU. Rates on Shanghai-Los Angeles surged 11% or $182 to settle at $1,856/FEU. Rates on Shanghai-Genoa inched up 1% to $2,268/FEU.

However, rates on New York-Rotterdam fell 5% to $969/FEU. Rotterdam-Shanghai and Los Angeles-Shanghai fell 4% each to $618 and $1,009/FEU, respectively. Rotterdam-New York have now dropped for 19 consecutive weeks and saw a weekly drop of 1% to $4,881/FEU.

Shanghai-Rotterdam hovered around the previous week’s level. Drewry expects East-West spot rates on routes other than the transatlantic to rise in the next few weeks.

In February, the major East-West headhaul routes experienced a significant decline in load factors due to low demand caused by global macroeconomic conditions.