-

Contract shipping rates from the Far East to the US West Coast are falling faster than rates from Southeast Asia as frayed US-China relations lead to “friend-shoring,” says a Xeneta analyst

-

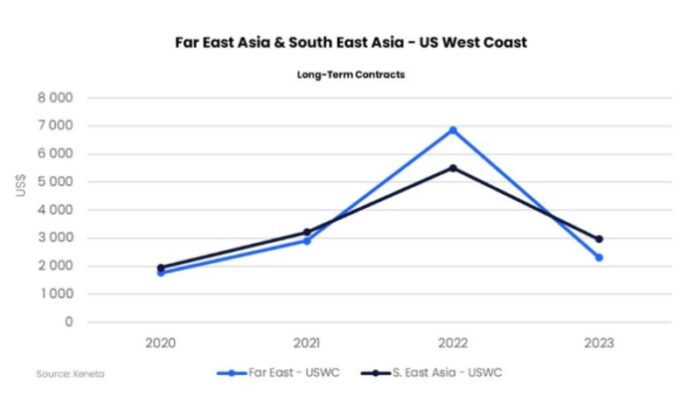

Long-term container rates from the Far East to the US West Coast have fallen 66% from a year ago, compared with a 46% drop from Southeast Asia, says Xeneta’s Mariana Garcia

-

Market-watchers Drewry and Freightos say spot rates are stabilizing after minimal declines on all routes excluding the transatlantic corridor

Far East to US West Coast (FE-USWC) rates fall faster these days than shipping prices from Southeast Asia as US-China relations are strained by political and economic issues, an analyst from online container trading and analytics platform Xeneta says.

Citing Xeneta data, Mariana Garcia noted the evolving differences between these two trades in a weekly rate update blog on April 6, as she said the US-China tensions are leading to “friend-shoring,” new commercial alliances that fuel the collapse of shipping rates on the traditional Far East-USWC corridor.

Garcia said contract rates from the Far East to the US West Coast have fallen 66% from a year ago, compared with a 46% drop from Southeast Asia.

“Whether you or your business stakeholders are friendshoring, considering it, or have never even heard of it, one thing’s for sure – it has significant potential to influence the global rates picture,” Garcia said.

As of April 6, spot prices on Drewry’s WCI composite index showed the Shanghai-Los Angeles rate sliding 2% to settle at US$1,736 for a forty-foot equivalent unit (FEU) while the Freightos Baltic Index for the same route fell 1% to $1,006/FEU.

Drewry expects East-West spot rates on routes other than the transatlantic to stabilize over the next few weeks.

Freightos head of research Judah Levine said: “Falling rates in March and into April, more blanked sailings announced for the coming weeks, and contract negotiations still up in the air given the continuing spot market slump may signal growing skepticism that any rebound has already begun or will kick in very soon.”

Garcia focused on Xeneta’s Asia-US West Coast long-term contracted rates against the backdrop of developments in US-China tensions over Beijing’s hardening positions on South China Sea and Taiwan issues.

RELATED READ: SEA-FE rates diverge amid ‘friend-shoring’

She said all eyes are on Asia as the West looks at partnerships in Southeast Asia as alternatives to its ongoing reliance on China, adding that Xeneta’s data provides food for thought to shippers who may be planning to move their production facilities elsewhere in the region.

“At first glance, the main takeaway is the collapse in container rates from the highs of 2022 to 2023’s lows. But it’s also critical to notice the evolving differences between these two trades,” Garcia said.

She said FE-USWC rates fall faster than those from Southeast Asia at a $650 price difference between the two trades currently, with Southeast Asia being more expensive.

“However, if we look back to 2022, we see a very different picture, with the Far East-USWC trade commanding a strong premium over its counterpart. The difference between the trades at this point was $1,350,” Garcia said, adding that a significant difference in the pace of rate reduction fueled the reversal.

For the past week, Drewry’s composite World Container Index was relatively stable at $1,709.76/FEU container, now 84% below the peak of $10,377 reached in September 2021. It shed a marginal 0.4% and has dropped 79% when compared with the same week last year.

Freightos’ Asia-US West Coast rate of $1,006/FEU is 94% lower than the same time last year while its

Asia-US East Coast prices also fell 1% to $2,097/FEU, now 88% lower than rates for this week last year.

However, Drewry said rates on Shanghai-Rotterdam inched up 4% to $1,532/FEU while Freightos’ Asia-N. Europe prices increased 1% to $1,344/FEU, 89% lower than rates for this week last year.

As of Friday, Drewry said carriers have announced 51 cancelled sailings between week 15 (10 April-16 April) and week 19 (8 May – 14 May), out of a total of 675 scheduled sailings, representing 8% cancellation rate.