-

Container prices across Asia dive as much as 55% y-o-y in March 2023 as sluggish consumer demand and excess inventory continue, Container xChange reports

-

Uncertainty around inventory restocking in H1 2023 is aggravated by highly uncertain consumer demand, with a likely recession affecting consumer spending in the US and European Union

-

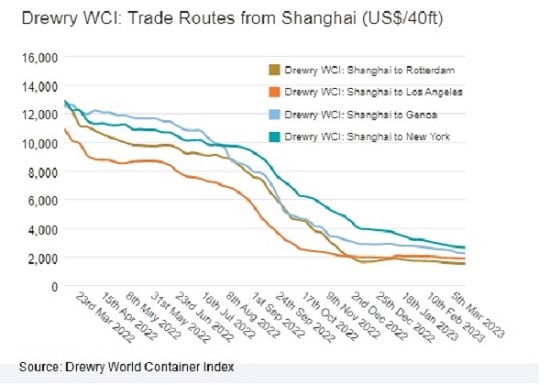

Drewry says its WCI composite index is 33% lower than the 10-year average of $2,691, indicating a return to more normal cargo shipping prices

Container prices in Asia fell as much as 55% year on year in March 2023 as sluggish consumer demand continued and excess inventory piled up, says Container xChange, an online platform for container logistics. Drewry, meanwhile, says cargo shipping rates are signalling a return to more normal levels.

Container xChange’s market forecaster report said container prices plunged 55% y-o-y to US$1,951 in Singapore and 47% to $2,284 in China in March 2023.

Shippers in Vietnam reported a 51% dive while container traders in India, Thailand, Malaysia and Indonesia saw box prices drop 50%, 46%, 42% and 40% y-o-y this March.

“In major ports across Asia, such as Ningbo, Shanghai, and Singapore, the cost of leasing and purchasing containers dropped sharply over the past year. This means that container companies are struggling to make money and that the current situation may persist for a while,” the report said.

In its February Asia News Update, Container xChange noted box rates in various regions were declining significantly, with contract rates moving closer to spot rates and that a hopeful prospect seemed unlikely in the immediate future.

Christain Roeloffs, CEO and co-founder of Container xChange, said that the uncertainty around inventory restocking in the first half of 2023 has been exacerbated by the highly uncertain consumer demand side of the picture, with the potential impact of a possible recession on consumer spending in the US and European Union region.

“This, in turn, signals a grim outlook for the revival of container prices any time soon,” he added.

The scenario where box prices dive as cargo rates are on a steady decline offers a relief to exporters and importers who, just months back, were captive to historically high charges aggravated by port congestion in Chinese, US and European ports.

On March 16, Drewry’s World Container Index composite index closed 1% lower, and was 80% below levels in the same week last year.

The latest Drewry WCI composite index of $1,790 per 40-foot container is now 83% below the peak of $10,377 reached in September 2021. It is 33% lower than the 10-year average of $2,691, indicating a return to more normal prices. But it remains 26% higher than average 2019 pre-pandemic rates of $1,420.

The average composite index for the year-to-date is $1,976 per 40-ft container (FEU), which is $715 lower than the 10-year average.

Another market watcher, Freightos, reported Asia-US West Coast prices (FBX01 Weekly) falling 3% to $1,040/FEU. This rate is 94% lower than the same time last year. Asia-US East Coast prices (FBX03 Weekly) dipped 3% to $2,265/FEU, still 88% below rates for this week last year.

Container xChange said that as part of a China plus one strategy, businesses are assessing and launching projects to test the waters by entering new countries to meet their supply chain demands.

Roeloffs noted that the strong economic partnership between Southeast Asia and China could provide a much-needed stimulus to the world economy.

“This year, shipping and port firms are considering proposals to establish additional tailor-made sea transportation routes, with Southeast Asia being a key area of interest. The cooperation between these regions could give a boost to the overall ramifications of the global supply chain.”