- The country’s external trade amounted to $18.30 billion in May, an annual growth rate of 21.5%, on the back of higher imports and exports

- Imports rose 31.4% and exports 6.2%

- The trade deficit widened 78.6% in May to $-5.68 billion year-on-year

- Electronic products remained the top import and export shipments in May

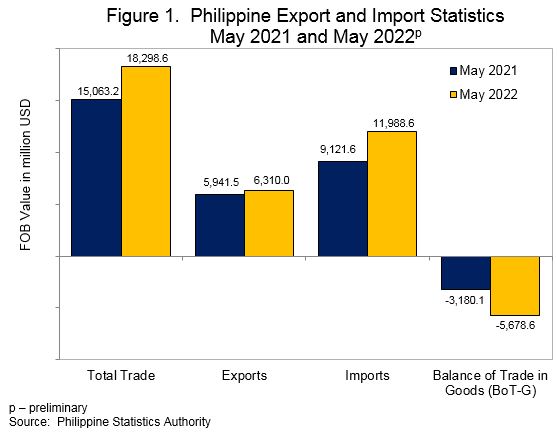

The country’s external trade amounted to $18.30 billion in May, an annual growth rate of 21.5%, on the back of higher imports and exports, according to a statement from the Philippine Statistics Authority.

Compared to April’s revised trade figure of $17.63 billion, the May figure inched up by 3.8%.

Imports amounted to $11.99 billion in May, up 31.4% year-on-year. Exports for the same month also rose but at a milder pace of 6.2% to $6.31 billion.

For the first five months of the year, imports jumped 29% to $56.80 billion from $44.02 billion year-on-year. For the same period, export earnings reached $31.87 billion, an annual rise of 8.4%.

The trade deficit in May widened 78.6% to $-5.68 billion year-on-year.

Electronic goods remained the country’s top import and export shipments for May.

Imports

The annual growth in the value of imported goods in May was mainly due to the increase in value of all the top 10 major commodity groups, led by mineral fuels, lubricants and related materials, up 128.7%. This was followed by cereals and cereal preparations which rose by 65.7 % annually; and iron and steel by 64.2 %.

Electronic products dominated imports, with a value of $2.78 billion representing 23.2% of all imports in May. It was followed by mineral fuels, lubricants and related materials, valued at $2.26 billion (18.8% share); and transport equipment which amounted to $908.95 million (7.6%).

By major type of goods, imports of raw materials and intermediate goods accounted for the biggest share of total imports reaching $4.61 billion (38.5%) in May. Imports of capital goods ranked second with a share of $3.36 billion (28.0%), followed by mineral fuels, lubricants and related materials with $2.26 billion (18.8%).

Imports of mineral fuels, lubricants and related materials recorded a positive annual growth of 128.7% from $986.81 million in May 2021. Contributing to the annual rise in this commodity group was the increase in import value of petroleum products used to run motor vehicles (includes diesel fuel and fuel oils, light oils and preparations, and aviation turbine fuel) with a value of $1.41 billion.

China was the country’s leading supplier of imported goods valued at $2.43 billion or 20.3 % of the total imports in May. Completing the top five major import trading partners are Republic of Korea, $1.21 billion (10.1% share); Japan, $1.04 billion (8.7%); Indonesia, $947.62 million (7.9%); and Taiwan, $740.37 million (6.2%).

Exports

Of the top 10 major export commodity groups, seven recorded annual increases in value in May led by coconut oil (180.5%), followed by other mineral products (32.9%), and chemicals (23.6%).

By commodity group, electronic products continued to be the country’s top export in May, with total earnings of $3.47 billion accounting for 55% of the total during the period. It was followed by other mineral products with an export value of $357.25 million (5.7%); and other manufactured goods which amounted to $305.57 million (4.8%).

By major type of goods, exports of manufactured goods accounted for the biggest in May, amounting to $4.97 billion (78.8%), followed by total agro-based products with a share of $593.87 million (9.4%); and mineral products which contributed $590.19 million (9.4%).

The US was the country’s leading export market in May, buying $940.09 million of Philippine goods or 14.9% of the total. Completing the top five major export trading partners are Japan, $900.46 million (14.3% share), Hong Kong, $896.02 million (14.2%), China, $865.74 million (13.7%); and Singapore, $382.98 million (6.1%).