-

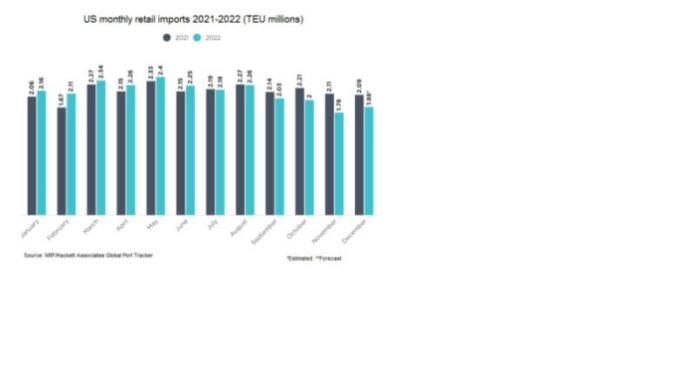

National Retailers Federation report showing December 2022 import volumes in major US ports fell 10% year on year below 2 million TEUs, suggesting normalizing demand

-

The NRF report sent out a signal that stabilized and normalized ocean rates last week, with Freightos Baltic Index closing mixed and Drewry’s composite index stable

-

Drewry said there were 158 cancelled sailings announced for week 3 on January 16-22 and week 7 on February 13-19, out of a total of 700 scheduled voyages

A National Retailers Federation report showing last December’s import volumes at the major United States container ports fell 10% year on year below 2 million TEUs (twenty-foot equivalent units), suggesting demand is normalizing, a signal that helped ocean rates stabilize and normalize last week, market trackers said.

The report’s impact visibly boosted the rate-cooling effect of ocean liners’ capacity cuts in the runup to the Chinese New Year and after the long holiday in China.

Drewry Supply Chain Advisors said there were 158 cancelled sailings announced for week 3 on January 16-22 and week 7 on February 13-19, out of a total of 700 scheduled voyages, representing a 23% cancellation rate.

Drewy said 68% of the blank sailings this week will be occurring on the Transpacific Eastbound, 25% on Asia-North Europe and Med, and 8% on the Transatlantic Westbound trade.

For the next five weeks, THE Alliance has announced 60 cancelations, followed by Ocean Alliance and 2M with 36 and 27 cancellations, respectively. During the same period, 35 blank sailings were implemented in non-alliance services as this keeps ocean rates steady.

The impact reflected on Ex-Asia container prices last week, which went largely unchanged, with Drewry’s composite World Container Index staying relatively stable at US$2,132.49 per 40-foot container, or 40 FEUs.

The Freightos Baltic Index Asia-US rates were mixed minimally, with container rates to the West Coast ports rising 1% as against a 1% price decline in shipments to the East Coast. Likewise, the FBX rates for Asia-North Europe fell 1%.

The NRF said the import volume fall should stay consistently below 2020-2021 levels through most of the spring. It also forecast that growth will return in the second half of 2023.

RELATED READ: High-box inflows at US ports throughout 2021

“Ports have been stretched to their limits and beyond but are getting a break as consumer demand moderates amid continued inflation and high interest rates,” said Jonathan Gold, NRF vice president for supply chain and customs policy.

He said consumers are still spending and volumes stay high, but the port congestion and ships waiting to unload that were widespread this time in 2022 are gone.

“It’s good to escape some of the pressure, but it’s important to use this time to address supply chain challenges that still need to be resolved like finalizing the West Coast port labor contract,” Gold said.

Hackett Associates, which tracked the port volumes, said imports plummeted to a four-year low of 1.37 million TEUs in March 2020 as COVID-19 prompted the temporary shutdown of much of the US economy. Pent-up consumer demand was unleashed after the shutdown that summer, topping 2 million TEUs by that August and staying there all but one month until this winter.

China’s COVID policy reversal is a good sign, Drewry said, but a surge in cases has been crippling supply chains once again as infected workers are forced to quarantine, increasing congestion at large ports such as Shanghai, Ningbo and Qingdao.

The impact on supply chains could yet be amplified by Chinese New Year starting January 22 as more people travel at this time, potentially triggering more infections, Drewry said.

Shippers and beneficial cargo owners exporting from China should expect more delays in coming weeks as most carriers adjust their schedules to avoid limited port and terminal operations during the upcoming festive period, Drewry said.

Freightos said last week, its Asia-US West Coast price index (FBX01 Weekly) increased 1% to $1,396/FEU,down 90% from the same time last year. Its Asia-US East Coast prices (FBX03 Weekly) dipped 1% to $2,858/FEU, and were 84% below rates this week a year ago.

Asia-North Europe prices (FBX11 Weekly) fell 1% to $2,712/FEU and were 81% lower than rates for the same week last year.

Asia-North Europe rates remain over 25% higher than in early 2020, possibly reflecting the impact of blanked sailings by carriers on this lane, Freightos said.