-

Container shipping markets are wary of how recent high-profile US bank failures impact the freight sector

-

Analysts say the banking troubles could hit consumer confidence and help slow freight demand

-

US West Coast recorded a major decline in total volume unloaded at Los Angeles and Long Beach ports dropping a startling 38% y-o-y and 21% m-o-m

Container shipping markets are wary of the recent high-profile US bank failures’ freight impact through erosion of consumer confidence, after ocean rates fell further last week and carriers continued to cancel sailings in a bid to reverse the price downtrend.

Silicon Valley Bank (SVB) collapsed on March 10 after the bank announced two days earlier it had suffered a US$1.8 billion after-tax loss and needed to raise capital to address depositor concerns. A bank run followed as customers frantically pulled out their money before US regulators took control.

US regional lender Signature Bank was shut down a week later while a third, First Republic Bank (FRC), has been propped up and the first major threat since 2008 to a bank of global financial significance, Credit Suisse, was averted after it was taken over by UBS.

The bank collapses came at a time when global trade hopes for a demand recovery later this year after a steady decline that began early last year.

“Bank failures signal the growing risk of a recession, and the most direct, near-term impact of these bank failures is likely to be seen in the response of consumers,” Breakthrough says in an analysis of the bank failures’ freight impact in mid-March.

“Consumer sentiment is likely to be negatively impacted by these failures and contribute to slowing freight demand as consumers change spending behavior in preparation for a potential recession.”

Freight demand has fallen across most industries over the past 6 months, bringing demand closely in line with 2019 levels.

Container imports on the US West Coast recorded a major decline with the total volume unloaded at Los Angeles and Long Beach ports dropping a startling 38% year on year and 21% month on month, Drewry reported.

“This decline in imports was attributed to weak demand due to the Chinese New Year holidays and the continued trend of shippers shifting from the West Coast to the East Coast. The weak figures also suggest that US importers are reducing their orders from Asia to rebalance inflated inventories,” Drewry said.

Across the major East-West headhaul trades, carriers trying to stem the price slide have cancelled 62 sailings between week 13 from March 27 to April 2 and week 17 from April 24 to April 30, said Drewry. The cancellations, announced on March 24, represent 9% of 665 scheduled sailings for those periods, the supply chain advisors said.

During this period, 63% of the blank sailings will be occurring in the Transpacific Eastbound, 31% on Asia-North Europe and Med, and 6% on the Transatlantic Westbound trade, Drewry said.

The latest Drewry WCI composite index of US$1,757 per 40-foot equivalent unit (FEU) of container is now 83% below the peak of $10,377 in September 2021.

The index is 35% lower than the 10-year average of $2,690, indicating a return to more normal prices, but remains 24% higher than the average 2019 (pre-pandemic) rate of $1,420, Drewry said.

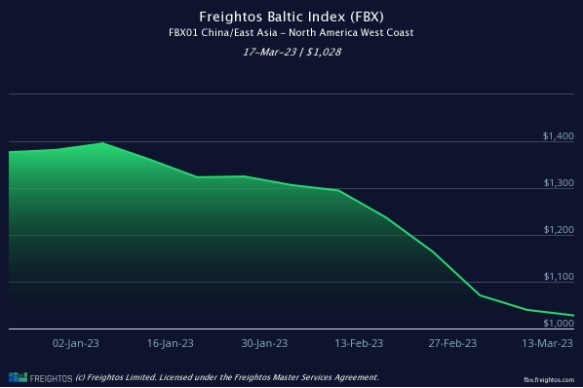

Spot rates for Asia-US West Coast shipments on the Freightos Baltic Index (FBX01 Weekly) slipped 1% to $1,028/FEU in the week to March 17, a 94% decline from the same time last year.

Rates on the Asia-US East Coast (FBX03 Weekly) corridor fell 3% to $2,198/FEU, 87% below rates for this week last year, while Asia-Northern Europe prices (FBX11 Weekly) decreased 7% to $1,414 and are 89% lower than year-ago levels.

Asia-Northern Europe prices fell another 7% to $1,414/FEU, nearly 90% lower than a year ago and just 13% higher than in 2019.

Judah Levine, head of research at Freightos, said steadily falling spot prices are complicating transpacific long-term ocean contract negotiations between large to mid-size shippers and ocean carriers, many of which would typically already be finalized by now ahead of the May start date.

Survey results released earlier this month by Xeneta, a container online trading and analytics platform, showed 71% of its shipper-customers were not renewing their long-term contracts.