-

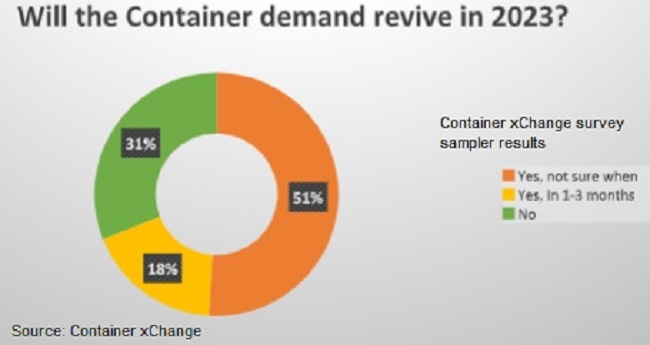

69% of freight forwarders surveyed are hopeful of container demand recovery in 2023, but few expect demand to emerge in 1-3 months

-

51% are “guestimating” a container demand rebound, but without a clear timeline

-

Average box prices fall up to 82% from 2021 at world’s busiest ports on sluggish demand

-

Eurozone inflation, US West Coast labor dispute and Panama Canal drought among key challenges for container logistics industry

Container prices slide as supply chain disruptions, such as the Panama Canal drought, labor strikes on the US West Coast ports, and a technical recession in the Eurozone hammer the industry’s reliability, Container xChange’s June Forecaster reports.

The report predicts a further slide in average prices in the coming weeks without signs of container demand revival, and a Container xChange survey of the global freight forwarding community in May 2023 reflects the sentiment.

About 69% of 406 of the respondents sampled are hopeful of a container demand bounce-back in 2023. Only 18% of this group expect a revival in the next 1-3 months, while about 51% are “guestimating” without a clear timeline for a container demand recovery.

“The supply-demand imbalance worsens with upcoming vessel deliveries and low scrapping rates. Spot rates are at pre-pandemic levels in most trades, and contract rates are sliding. Coupled with low demand, the industry continues to grapple with overcapacity of containers and vessels,” said Christian Roeloffs, cofounder and CEO of Container xChange.

“Now we have labour disruptions [on the US West Coast] and the Panama Canal drought, which in normal circumstances would lead to an uptick in freight rates as they absorb effective capacity, but any significant price effect is now highly doubtful.”

Roeloffs said for shippers, this means supply chain reliability will deteriorate again, potentially leading to a “pulling forward” of orders. This will likely flatten out any peak season and further decrease the likelihood of a freight rate increase in the second half of 2023, he said.

Container prices generally surge during preparation for the peak season. So far, prices have failed to rise, Roeloffs said. A study of average container prices on the Container xChange platform shows a disappointing demand revival.

Average box prices across some of the busiest ports in the world have fallen to their lowest in the last three years. The data indicates poor demand for containers so far until June. In New York, the average price of 20-ft dry containers reached US$6,500 in June 2021; it has since crashed 82% to $1,175 in the first week of June 2023.

Similarly, Long Beach Port saw the average prices peak at $4,118 at the beginning of August 2021, only to drop 65% to $1,430 in May 2023. This price slide comes as the shipping industry prepares for a “supposed peak season”.

“There are enough and more reasons to be pessimistic. With the peak season coming, the industry sentiment is negative. The industry is waiting for a demand comeback, which doesn’t seem [to be] anywhere on the horizon,” said Roeloffs.

RELATED READ: Container prices plunge due to slow demand

“In a highly competitive environment such as container shipping, the minimum offer price tends to gravitate towards the level of variable costs. In the case of container transportation, variable costs have surged 15-25% since 2019, depending on the trade lane.”

Roeloffs said consequently, the lower limit of freight rates offered by carriers had also risen 15-25%, posing challenges to shippers who now face higher variable costs for transporting cargo.

Despite the significant decline in average container rates from 2021 to 2023, reaching almost an 85% reduction, the underlying variable costs remain elevated, making a significant additional and sticky decrease in spot rates unlikely while contract rates still have room to fall, he said.

The National Retail Federation (NRF) says US retail sales are slowing and container imports are on track to drop more than 20% in H1 2023.

Roeloffs said the impact of inflation on the global supply chain can be significant and wide-ranging. Rising input prices and costs of financing, change in consumer behavior and changing trade behaviors will have a ripple effect on global supply chains.

“Businesses will need to adapt their production levels, inventory management, and distribution strategies accordingly,” he said, as consumer demand will remain persistently slow for the peak season and sticky inflation is poised to have additional detrimental impact on demand.