-

The Philippine manufacturing sector in December posted its weakest growth in three months

-

The Philippines’ Purchasing Managers’ Index fell from November’s nine-month high of 52.7 to 51.5 in December

-

Output and new orders continued to rise, albeit at a softer pace

-

Firms noted growing supply-side challenges with average lead times lengthening again in December

-

Looking ahead, business confidence across Filipino manufacturers remained strong

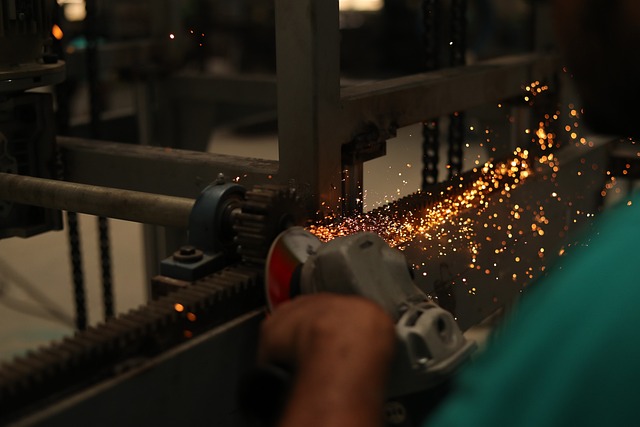

The Philippine manufacturing sector in December posted its weakest growth in three months, according to S&P Global.

The Philippines’ Purchasing Managers’ Index fell from November’s nine-month high of 52.7 to 51.5 in December. (An index above 50 indicates an expansion.) This indicates a modest improvement in operating conditions, supported by expansions in output and new orders, although one that was the weakest in three months, S&P Global noted.

“The year concluded with yet another expansion across the Filipino manufacturing sector,” S&P Global economist Maryam Baluch said.

“Output and new orders continued to rise, albeit at softer rates. Firms also remained hopeful that production will increase in the coming year,” Baluch added.

S&P Global said central to the slowdown across the manufacturing sector was a notable softening in new order growth. The rate of increase was the weakest in the current four-month period of expansion and modest overall.

Moreover, total sales growth was focused domestically as the demand picture across international export markets deteriorated, with manufacturers reporting a fresh and solid fall in new export sales in December.

Similarly, manufacturing output also expanded at a weaker rate. Despite easing to the slowest in three months, growth in output remained strong, in part supported by a sustained rise of new orders. A further rise in production requirements prompted a renewed rise in purchasing activity following the first fall recorded in 15 months during November.

Firms also noted growing supply-side challenges with average lead times lengthening again in December. Congestion and longer delivery times for imports were blamed for delays.

Moreover, vendor performance deteriorated at the greatest extent in five months.

With growth in new orders slowing, however, firms were able to continue to clear their backlogs.

In light of evidence of spare capacity within the sector, manufacturers were prompted to reduce their staffing levels. Filipino manufacturing employment fell for the second successive month, and at a quicker pace.

On the prices front, while inflationary pressures remained historically muted, upticks were noted in the rates of both input price and output charge inflation. Rising cost burdens were largely attributed to increased fuel, material and shipping prices. In turn, firms raised their selling prices. The rates of inflation were the strongest seen since the fourth quarter began.

Looking ahead, business confidence across Filipino manufacturers remained strong. Though strengthening only fractionally since November, the degree of confidence lifted to a four-month high. Hopes of improving demand conditions and plans for increased marketing campaigns boosted optimism, S&P Global said.