-

Panama Canal restrictions could hit Christmas stocks and supply chains, as vessel congestion and the receding water level is delaying supply deliveries to US retailers

-

Vessels’ prolonged wait times and capacity limitations will have a ripple effect across the shipping sector, Container xChange says

-

Stakeholders need effective coordination and communication to address the Panama Canal congestion’s impact on trade routes and container prices

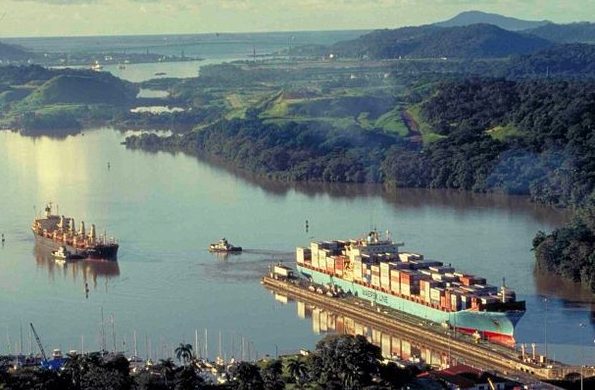

Ongoing Panama Canal restrictions may hit Christmas stocks on ships transiting the waterway, as congestion builds up and the water level continues to drop, delaying supply deliveries to US retailers, shipping and trade analysts say.

With the Christmas shopping season near, the delay in inventory restocking due to the disruptions and congestion at the canal could cause missed sales opportunities, Container xChange said in a market update.

The disruptions have raised concerns about the ability of businesses to replenish their inventories in a timely manner due to shipping delays, Container xChange said, adding that there is a looming threat of shortages for select goods during the critical Christmas shopping period if the delays continue.

“Ongoing challenges at the Panama Canal are making existing worries for industries even worse. New industry information shows that the US economy’s consumer spending has seen an uptick, which is good,” remarked Christian Roeloffs, cofounder and CEO of Container xChange.

“With inventories falling and demand expected to rebound, the Panama Canal, which carries 40% of container traffic from Asia to Europe, is likely to experience increased pressure.”

The Panama Canal Authority announced on August 16 water conservation measures that will last until September 2 due to a drought. Vessels are having prolonged wait times and capacity limitations, resulting in a ripple effect across the shipping sector, the online platform for container logistics said.

Prominent industry sources, including Alphaliner, Sea-Intelligence, and Drewry, have reported a notable increase in blanked sailings – the practice of cancelling scheduled sailings to manage capacity. Specifically, during June and July, about 10.8% of the regular sailings connecting Central China and Europe were cancelled, Container xChange said.

On August 18, Drewry reported 36 cancellations by major carriers on August 21-27 and September 18-24 due partly to the Panama Canal restrictions, with 58% of the blank sailings occurring on the transpacific eastbound, 17% on the Asia-North Europe and Med, and 25% on the transatlantic westbound trade. Comparable patterns have also emerged on the transpacific trade lanes.

Container xChange said as a direct result of these capacity reductions, the market has witnessed a corresponding rise in spot freight rates. This outcome aligns closely with earlier projections made by industry experts.

The Panama Canal Authority’s move to conserve freshwater has contributed to a substantial backlog of vessels – currently around 200 – awaiting their turn to transit through the canal. Waiting times have surged to a peak of 21 days, introducing significant delays across multiple segments of the shipping industry.

Given the canal’s role as a vital trench for US shippers, who channel 40% of all US container traffic through the waterway annually, the ramifications of the disruptions are extensive, Container xChange said.

The restriction of booking slots and adjustments to vessel weight requirements have compounded the backlog, further lengthening waiting times. This is straining shipping schedules, potentially leading to disruptions along supply chains and likely have knock-on effects on pricing structures.

The Panama Canal plays a critical role for US shippers en route to Gulf and East Coast ports. The US accounts for 73% of Panama Canal traffic representing about $270 billion in cargo.

The knock-on effects are also expected to affect costs. The need for alternative routes and the resulting longer lead times due to the congestion can increase carriers’ operational expenses, which may eventually be passed down to businesses and consumers alike, Container xChange said.

“These supply chain disruptions are expected to reverberate throughout the industry, with potential consequences for container prices. The ongoing congestion and reduced capacity have led to heightened competition for available slots, driving up spot freight rates,” Roeloffs said.

“The scarcity of available vessel capacity has prompted carriers to re-evaluate pricing strategies to offset increased costs and uncertainties. Consequently, the traditional equilibrium of container prices may experience adjustments to accommodate the challenges of the Panama Canal congestion.”

Container xChange said against this backdrop, collaboration among stakeholders becomes even more pivotal. Effective coordination and communication will be instrumental in addressing the multifaceted effects of the Panama Canal congestion on global trade routes and container prices.