-

Container cargo volume at the Port of Los Angeles fell 21% to 639,344 TEUs in November as retailers shifted their import shipments elsewhere and demand slowed

-

The port’s container cargo throughput for first 11 months of 2022 was 7% less than last year’s all-time record

-

North America’s former No.1 port faces a further volume squeeze as CNBC reported a 40% drop in US manufacturing orders in China that will force factories to close a week early for the Lunar New Year in January

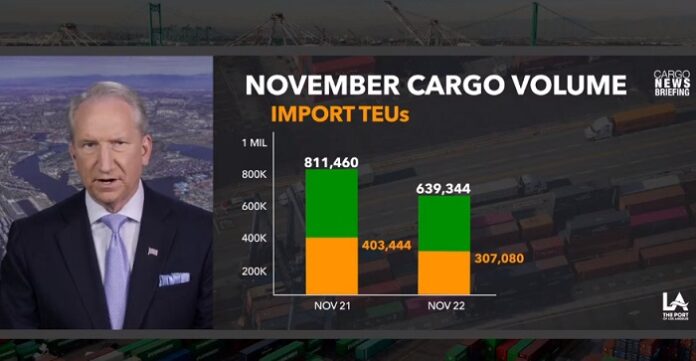

Cargo volume remained soft at the Port of Los Angeles last month with the gateway handling 639,344 twenty-foot equivalent units (TEUs). The November box throughput drop of 21% year on year came as shippers continued to shift imports away from the US West Coast and shipping demand weakened.

Overall, North America’s former busiest port reported that its container cargo throughput in the first 11 months of 2022 was 7% less than last year’s all-time record.

Port of LA executive director Gene Seroka said in a briefing on December 14 that the November volume represents a 24% decline from the port’s five-year average container throughput.

“Imports into the United States have begun to level off, in addition to cargo that has shifted away from West Coast ports due to protracted labor negotiations,” said Seroka during his last media briefing for 2022.

The throughput drop in November added to Seroka’s concern amid the prospect of a further volume decline in the months ahead after the latest CNBC Supply Chain Heat Map data showed a 40% dive in US manufacturing orders in China.

Americans have been reining in non-essential purchases since mid-year due to rising inflation and economic uncertainty.

CNBC said in a report that as a result of the order plunge, Worldwide Logistics told the broadcaster it expects Chinese factories to shut down two weeks earlier than usual for the 10-day Lunar New Year holiday starting on January 21, 2023.

The station said US logistic managers are bracing for delays in the delivery of goods from China in early January due to canceled sailings of container ships and rollovers of exports by ocean carriers.

“In the months ahead, we’re going to have to work harder and smarter to earn cargo back. Every ship, every train, every truck needs to be handled with the top-level service our customers expect and deserve.”

Seroka was joined at the briefing by Jeremy Nixon, chief executive of Ocean Network Express (ONE), one of the world’s largest shipping carriers. Nixon discussed the trade outlook for 2023 as well as ONE initiatives to improve service for its customers.

November 2022 loaded imports reached 307,080 TEUs, down 24% year on year. Loaded exports came in at 90,116 TEUs, up 9% from November 2021. Empty containers landed were 242,148 TEUs, down 26% y-o-y.

Seroka said despite the increase in export TEUs, they are still 34% lower than the port’s five-year average. He attributed the year-on-year drop in the stockpile of empty containers at the port to an early peak season and the cargo shift to other ports that was partly fueled by fears of a labor strike if the dockworkers union and the port management fail to sign a new contract.

“We are still on track to finish 2022 just under 10 million TEUS, our second-best performance ever outpaced only by last year,” said Seroka.

He urged all port stakeholders to go out to customers and try to get the cargo back to Los Angeles

For 22 years, the Port of Los Angeles had been the busiest port in North America and the Western Hemisphere until the shift of cargo to the US East Coast in June gave the accolade to Port of New York and New Jersey in August, September and October.