-

A recent survey by Container xChange shows that 88% of logistics industry experts expect a heavier blow this year from inflation and recession in 2022

-

The survey results, published in Container LogTech Predictions for 2023 report, show 67% of respondents favor India and Vietnam over “China + 1” strategy

-

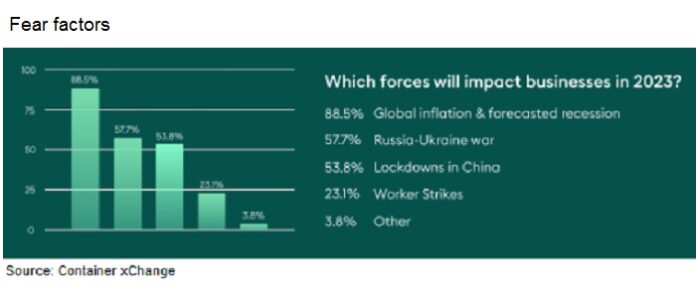

Fear of more workers’ strikes causing global supply chain disruptions is also a factor

An overwhelming 88% of logistics industry experts forecast that inflation and recession will have a greater impact this year than in 2022 and be the biggest driver of supply chain disruptions, according to a recent survey.

The survey, conducted by Container xChange, also found out that 67% of poll respondents consider India and Vietnam as attractive alternatives to the “China + 1” investment strategy and expect the US to emphasize “friendshoring” in 2023.

Their forecasts make up the Container LogTech predictions report for 2023 that highlights important global trends that the shipping and supply chain industry will witness this year.

The report draws attention to some of the most pertinent issues that the industry will witness this year, thereby helping professionals to prepare better for navigation.

The survey findings are as follows:

67% of supply chain leaders polled by Container xChange consider India and Vietnam as attractive alternatives to “China plus 1” investment strategy while they expect the US to emphasize ‘friendshoring’ in 2023

88% of respondents consider inflation and recession fears as the biggest impeding factor for businesses in 2023, followed by “implications of war” at 57%, “impact of COVID in China” at 53%, and “worker strikes” at 23%

Experts predict that worker strikes will rise in 2023

Most respondents expect container rates and contract rates will fall further in 2023 as, along with inflation, recession tops fears of players in the logistics sector.

“The overall outlook for the year 2023 remains gloomy. Europe is hit hard with an all-time high inflation; China struggles to cope with the virus and the US continues to witness hinterland transportation challenges and labor unrest,” said Christian Roeloffs, cofounder and chief executive of Container xChange.

“Most of these challenges will stay in 2023. Consumer confidence will pick up, but it really depends on whether we witness more disruptions in the coming times.”

RELATED READ: Container logistics leaders bullish

Aamir S. Mir, chief operating officer of Caspian Container Company SA, one of the industry experts interviewed for the survey, predicts more labor unrest this year in the West.

“Due to inflation increasing, there’ll be more unrest in the labor market, which will certainly lead to more strikes, specifically in Europe, the UK and North America. And, as we have seen before, strikes result in slow operations within the port, which can exacerbate supply issues,” Amir said.

The report predicts that long-term shipping contract rates will rise in 2023, though gradually and applies to all modes of transport. With negotiations going on to bring contract rates in line with spot rates, a reset is expected. Until a balance is reached between supply and demand, forwarders will favor short-term contracts until the rates stabilize.

“Freight forwarders will employ a ‘wait and see’ approach before making any long-term air cargo capacity commitments particularly,” the report says.

RELATED READ: Shipping costs bottlenecks worsening global inflation

Trucking rates for dry and reefer cargoes will continue to drop in 2023. Freight tonnage contract will fall further as market conditions and volumes return to pre-pandemic numbers.

Unresolved worker strikes of 2022 will spill over into 2023. The chances of new strikes are high due to price inflation putting pressure on workers’ disposable incomes. Labor dissatisfaction might grow in Europe and North America, causing global supply chain disruptions.

“Two, almost three exceptional years for carriers are definitely coming to an end. They will have to adapt back to lower margins due to a different supply and demand balance. Many customers, forced into high-cost contracts during the up-cycle will come for revenge in the down-cycle,” said Ruben Huber, founder and director of OceanX.

“And regulatory pressures, following excessive profits, might appear on top of that, be it through bodies like FMC, EU or China’s MOC, as they each review alliance exemptions, new taxation regulations, or precedence cases from several complaints raised by shippers at different institutions.”

The report further covers growing expectations of the third-party logistics (3PL) market to solidify in 2023. Reportedly, the market is projected to reach US$1,789.74 billion by 2027.

Another key trend on the list is around the digital transformation of the industry. In the coming years, adoption of digital technologies in shipping will focus on vessel schedules, intuitive booking interfaces, instant slot booking, and capacity confirmations.

In this regard, the industry’s major concern will be on having systems interact directly via automating the Data-Analysis-Decision-Action cycle.

The full report from at https://www.container-xchange.com/reports/2023-predictions/