-

254 applications for tax and duty exemptions amounting to P8.7 billion on COVID-19 vaccine imports were granted by DOF as of December 31, 2021

-

The foregone revenue represents 37% of the P23.4 billion total tax and duty exemptions processed last year

-

823 applications for VAT exemptions on imports of COVID-19 medicines and medical devices were also processed, resulting in foregone VAT revenue of P382.1 million in 2021

-

P211 million worth of tax refunds were also approved last year

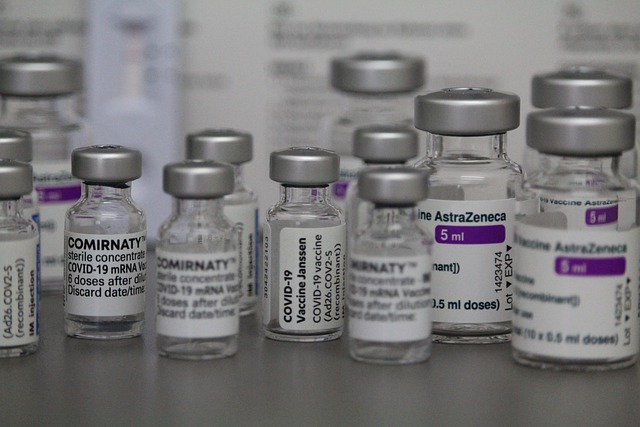

The Revenue Office (RO) of the Department of Finance processed a total of 254 applications for tax and duty exemptions on COVID-19 vaccine imports amounting to P8.7 billion as of end-December 2021.

In a report to Finance Secretary Carlos Dominguez III, the Revenue Operations Group (ROG) said the approved applications that were issued Tax Exemption Indorsements (TEIs) were among a total of 276 such requests the office received from vaccine importers last year.

The foregone revenue of P8.699 billion from these TEIs represent 37% of the P23.4 billion of the total tax and duty exemptions processed by the team last year, DOF Assistant Secretary Dakila Elteen Napao of the ROG said in his report.

“Estimated foregone revenue is returning to its pre-pandemic figure of P23.9 billion in 2019. However, this is primarily due to the forgone revenue attributable to importations of COVID-19 vaccines, as well as importations of items related to COVID-19 response,” Napao said.

Dominguez earlier approved the inclusion of all importations of COVID-19 vaccines in the Mabuhay Lane or express lane of the RO to allow for quick processing within 24 hours of the tax and duty exemptions of these vital shipments.

READ: Under DOF express lane, COVID vaccine imports enjoy quick tax, duty exemption processing

He also approved waiving of filing fee for COVID-19 vaccine applications under the Mabuhay Lane and the use of the Tax Exemption System (TES) Online Filing Module in processing the vaccine imports to further support the government’s speedy rollout of the COVID-19 vaccination program.

Created on May 13, 1994 through Department Order 29-94, the Mabuhay Lane is tasked to quickly process applications for tax and duty exemption of certain groups of importers. These groups include export-oriented firms, returning residents (balikbayans) and non-profit, non-stock educational institutions.

Napao said the RO also issued TEIs to 823 applications for value-added tax exemptions on imports of COVID-19 medicines and medical devices, which resulted in forgone VAT revenue of P382.1 million in 2021.

Meanwhile, the Financial Analytics and Intelligence Unit (FAI), which is also under the ROG, approved P211 million worth of tax refunds referred to the DOF by the Bureau of Customs last year.

The FAI was institutionalized under Executive Order No. 46 to serve as the data analytics unit of the DOF for purposes of revenue management and to review matters that may be deemed fiscally adverse to the government.

These include cases elevated by agencies, bureaus and offices attached to DOF for the approval and conformity of the Secretary of Finance, among other key functions.