Hong Kong flag carrier Cathay Pacific recorded an attributable loss of HKD9.865 billion (US$1.273 billion) in the first half of 2020, as the airline described the period as the most challenging in its more than 70-year history.

Hong Kong flag carrier Cathay Pacific recorded an attributable loss of HKD9.865 billion (US$1.273 billion) in the first half of 2020, as the airline described the period as the most challenging in its more than 70-year history.

The loss reverses the company’s first-half profit of HKD1.347 billion in 2019, according to group chairman Patrick Healy.

“The impact of COVID-19 on the Group’s business and the global economy is unprecedented. The global health crisis has decimated the travel industry and the future remains highly uncertain,” he said in a statement on August 12.

Before the pandemic, Cathay Pacific was one of Asia’s largest international airlines and the world’s fifth largest air cargo carrier.

Sister airlines Cathay Pacific and Cathay Dragon reported a loss after tax of HKD7.361 billion in the first half of 2020 from a profit of HKD675 million year-on-year.

The share of losses from subsidiaries and associates was HKD2.504 billion as against the 2019 first-half profit of HKD672 million, the company said.

This first-half loss also includes impairment charges of HKD2.465 billion relating to 16 aircraft that are unlikely to re-enter service again, in addition to certain airline service subsidiaries’ assets.

Passenger revenue over the first six months decreased by 72.2% to HKD10.396 billion, reflecting the precipitous drop in passenger demand resulting from the extensive travel restrictions, border controls and quarantine arrangements implemented worldwide in response to the COVID-19 pandemic.

The company carried just 4.4 million passengers in the first half of the year, down 76.0% from 18.261 million year-over-year, and load factors dropped to 67.3%.

Cargo revenue grows

The cargo business fared relatively better. It recorded an 8.8% increase in cargo revenues compared to the first half of 2019. This was due to an imbalance between demand and available capacity, as airlines globally cut flights. This imbalance helped push Cathay Pacific’s cargo yields up to HKD2.71 in the first half of the year, a 44.1% increase over 2019.

But total cargo carried dropped 31.9% to 667,000 tonnes, affected by cuts made to passenger capacity since about half of the airline company’s cargo is typically carried in the bellies of its passenger aircraft.

In response, the airline mounted additional capacity to help fly in needed medical supplies and equipment swiftly. It increased the utilization of its freighters by chartering flights from Air Hong Kong, its all-cargo subsidiary, and by operating a total of 2,228 pairs of cargo-only passenger flights between March and June.

The carrier also began carrying certain cargo in the passenger cabins of its Boeing 777-300ERs. These measures pushed load factors up by 5.9 percentage points to 69.3%.

Overall, cargo capacity for the first six months of the year was down 31% on the previous year.

On the cost side, Cathay Pacific and Cathay Dragon’s total fuel costs dropped by HKD7.640 billion, or by 52.6%, taking fuel hedging into account.

Non-fuel costs rose by 34.1% per available tonne kilometer to HKD2.99. The increase was a result of the very significant reductions in network capacity, as some costs are fixed or only semi-variable and cannot be reduced in proportion to capacity reduction.

Fighting for survival

In the first six months of the year, the company quickly put measures in place to reduce costs and preserve cash amid the extremely challenging operating environment created by COVID-19, Healy said.

These included significant passenger capacity reductions, executive pay cuts, and suspension of projects and of non-essential spending.

The company also negotiated concessions from suppliers and deferral of payments to them, closed some of its outport cabin crew bases, and introduced two voluntary leave schemes.

It has reached agreement with Airbus to defer delivery of its A350-900s and A350-1000s from 2020 and 2021 to the 2020-2023 period, and its A321neos from 2020-2023 to the 2020-2025 period.

“And we are in advanced negotiations with Boeing for the deferral of our 777-9 deliveries,” said Healy.

Looking forward, he said the operating environment will remain extremely challenging as demand recovery in recent months has been extremely slow. Moreover, IATA recently pushed back its forecast for a return to pre-COVID international passenger demand to 2024, a year later than its previous estimate.

And with a global recession looming, and geopolitical tensions intensifying, “trade will likely come under significant pressure, and this is expected to have a negative impact on both air travel and cargo demand,” Healy added.

Passenger schedule for September remains substantially reduced, with a similar capacity level to that seen in August. The company will continue to assess the possibility of adding more flights and destinations in October, but said demand will continue to be highly dependent on travel restrictions.

Healy also said that a HKD39 billion recapitalization that was announced in June has just been completed, and that Cathay Pacific must find a way to return to profitability in order to generate that return on investment for its shareholders and the Hong Kong government.

Thus, expecting no return to normal demand conditions any time soon, Healy said the management team is reviewing the company business model, and in the fourth quarter of this year it will be recommending to the board “some very tough decisions” that are necessary to allow the company’s return to sustainable financial health and long-term survival.

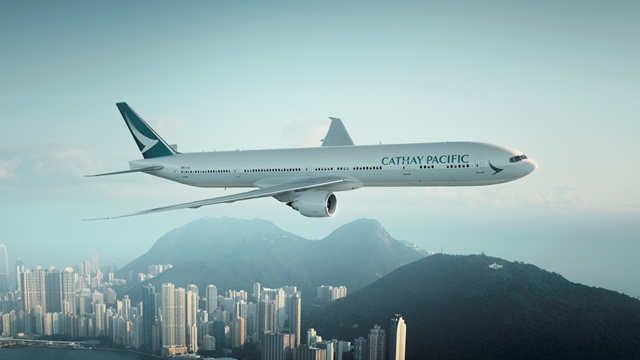

Photo courtesy of Cathay Pacific