-

The Bureau of Customs collected more than P1.5 billion in duties and taxes in 2021 through the conduct of audits

-

The amount collected by the Post Clearance Audit Group was 25% more than last year’s

-

The additional revenue resulted from the issuance of 349 Audit Notice Letters

-

More revenues are expected with 55 demand letters amounting to more than P12.4 billion now final and executory for failure of audited importers to contest the same

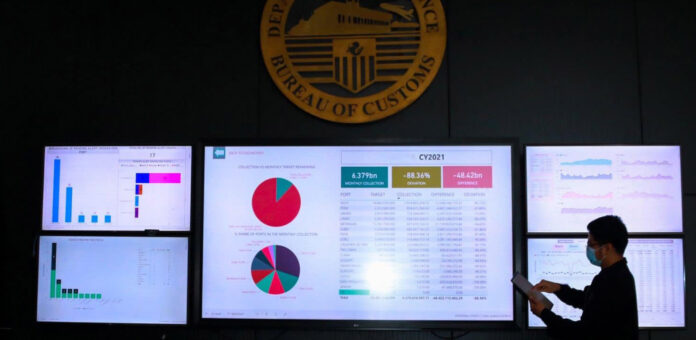

The Bureau of Customs through the Post Clearance Audit Group (PCAG) collected P1,522,216,793.42 in duties and taxes for 2021, up 25% year-on-year.

The additional revenue resulted from 349 Audit Notice Letters (ANL) issued, PCAG said in its annual accomplishments report delivered at a recent executive committee meeting.

PCAG said it is optimistic of taking in more revenues since there are other cases that have yet to be resolved since 2019, the BOC said in a statement.

Specifically, there are 55 demand letters amounting to P12,468,110,546.82 which have become final and executory for failure of audited importers to contest the same. The cases are now being referred to the BOC Legal Service for filing of the collection suit.

BOC commissioner Rey Leonardo Guerrero and assistant commissioner Vincent Philip Maronilla, who heads the PCAG, emphasized the importance of the post clearance audit and the additional revenues it generates especially as the nation continues to recover from the impact of COVID-19.

The post-clearance audit, formerly post-entry audit, unit returned to the BOC in 2016 from the Department of Finance, which took over the unit from the BOC in 2014.

In 2018 PCAG started welcoming applications to Prior Disclosure Program and in early 2019, began sending out ANLs with the release of Customs Administrative Order No. 01-2019, which implements BOC’s post-clearance audit functions.

READ: BOC to commence audit of firms with release of post-clearance audit order

Under the order, within three years from the date of final payment of duties and taxes or from customs clearance, BOC may conduct an audit examination, inspect, verify, and investigate records pertaining to any goods declaration. The declaration includes statements, declarations, documents, and electronically generated or machine-readable data.

Such audit intends to ascertain if the goods valuation is correct and determine if the importer is liable for duties, taxes, and other charges, including any fine or penalty.