-

Parcel volume reached 161 billion in 2022, up 1% from 159 billion in 2021

-

5,102 parcels shipped per second versus 5,052 in 2021

-

Parcel revenue was US$485 billion, down 1% from $489 billion in 2021

-

China is still the largest parcel volume market, helping drag the market with low 2% volume rise

-

US still had the highest carrier revenue, at $198 billion, up 7% y-o-y

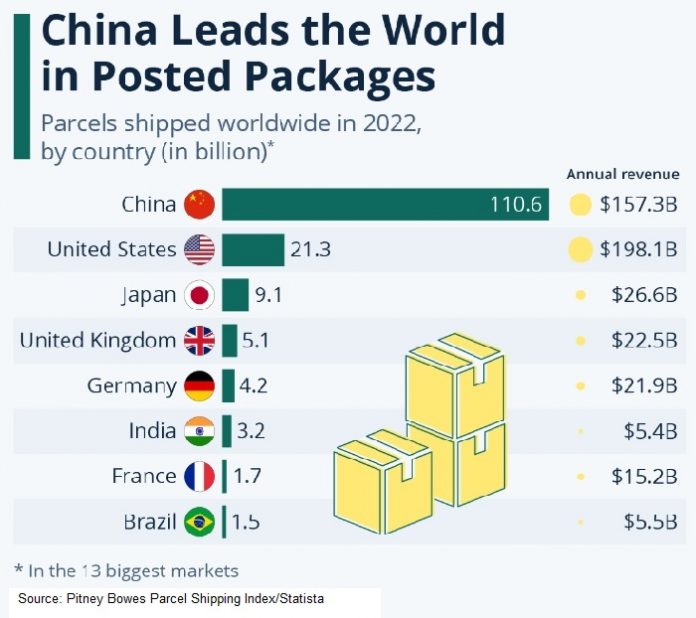

Global e-commerce leader China’s COVID-19 lockdowns impacted 2022 global parcel shipping with volumes reaching 161 billion, or 5,102 packages shipped every second, a minimal growth of 1% year on year, according to the Pitney Bowes Inc. Global Parcel Shipping Index.

The US global shipping and mailing company’s annual index, released on August 10, reveals that China experienced the slowest growth in its history, with 110.6 billion parcels, or only a 2% increase.

China led the 13 major countries worldwide whose 2022 data were unveiled by Stamford, Connecticut-based Pitney Bowes Inc. in a press release. The two other leading countries are the United States with 21.3 billion parcels, and Japan with 9.1 billion, according to the index.

Of the three, the US had the largest annual revenue from parcel shipments of US$198.1 billion, versus China’s $157.3 billion and Japan’s $26.6 billion.

The 13 biggest shipping markets globally accounted for 161 billion posted packages in 2022, up just 1% y-o-y. The minimal growth reflects the COVID lockdowns’ impact on China in 2022 that hampered growth after a banner year in 2021 due to stay-at-home mandates and movement restrictions, the report said.

Statistics provider Statista cites the rise of e-commerce platforms like Alibaba as one of the main growth factors in the courier, express and parcel (CEP) sector even before the pandemic. In the US, revenue rose nearly $90 billion from 2017, while the total CEP industry generated an estimated worldwide revenue of $485 billion in 2022, Statista said in a related report with the chart above.

“China parcel volume had maintained a double-digit growth rate every year from ‘13 to ’21. However, in 2022, COVID-related lockdowns caused a sharp slowdown,” said Gregg Zegras, executive vice president for global e-commerce at Pitney Bowes.

“As the world’s second-largest economy, China is experiencing a frail pace of growth during its COVID recovery. We’re seeing volume slowdown, declining ecommerce sales, and an overall weak economy, projecting a 7% parcel volume CAGR (compound annual growth rate) for 2023-2028.”

The pre-pandemic China parcel volume forecast was 25% CAGR for 2018-2022 and actual volume growth was lower at a 22% CAGR for the same period, Pitney Bowes said. Over the past seven years, global parcel volume surged 150% from 64 billion in 2016 to 161 billion in 2022, it said.

In 2022, India had the highest volume increase at 18% driven by e-commerce expansion, while Italy had 4%, China 2%, Australia 2%, and Brazil 2%. Sweden and Canada experienced declines at 11% and 9%, respectively.

In 2022, global parcel shipping revenue declined 1% to $485 billion, impacted by a strong US dollar and its appreciation compared to other currencies in the Index, Pitney Bowes said.

Only the US, Brazil, India, and Australia saw growth in parcel revenue, with the US leading in carrier revenue with 7% growth in 2022. Revenue per parcel varied, with Canada the highest at $9.80, followed by the US at $9.30 and France at $9.10.

The US generated more revenue than China due to a significantly higher fee per parcel – almost seven times that of China, whose revenue per parcel is $1.40, the lowest globally. India follows India at $1.70 and Norway at $1.90.

While there is strong alignment between parcels per person and GDP per capita in the US, Germany, Brazil, and India, parcels per person in China, Japan, and the UK exceed GDP, most likely due to significant exports, Pitney Bowes said.

In Norway, Sweden, and Australia, there is a reverse effect with low parcels per person versus GDP, suggesting a fairly low penetration of e-commerce.

RELATED READ: China’s cross-border e-commerce hits US$280B