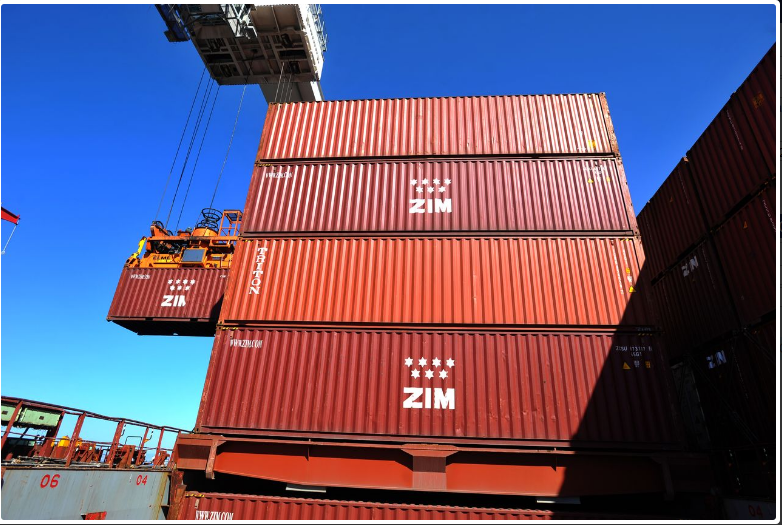

Despite higher revenues and strong volumes, Zim Integrated Shipping Services reported a deeper net loss in the first quarter of 2018, adversely affected by challenging shipping conditions.

Despite higher revenues and strong volumes, Zim Integrated Shipping Services reported a deeper net loss in the first quarter of 2018, adversely affected by challenging shipping conditions.

For the first three months ending March 31, 2018, Zim registered total revenues of US$751.4 million compared to $655 million in Q1 2017, a 14.7% increase.

It carried 698,000 TEUs, up 16.7% from 598,000 TEUs in the same period a year ago and an all-time record, said the Israeli-based container liner in a statement.

But average freight rate per TEU was down 1.6% to $938 from $953 in Q1 2017.

The company logged a net loss of $34.1 million compared to net loss of $6.4 million in Q1 2017. With adjustment, net loss for the period was $26.1 million compared to adjusted net profit of $2.6 million in Q1 2017.

Eli Glickman, Zim president and CEO, said: “During Q1 of 2018, Zim has increased the volume of cargo carried to 698 thousand TEUs, thanks to intensive sales efforts and customers’ confidence in Zim. This has been achieved despite very challenging market conditions.”

But, he added, “while we started to see an improvement in some of the trades towards the end of the quarter, Q1 2018 results, on the whole, were negatively impacted by the combined effect of increased bunker prices, higher charter costs and lower freight rates.”

He described the container shipping industry as marked in recent years by instability and changing market conditions. “Since the second half of 2016 and through the third quarter of 2017, increases were recorded in freight rates as well as in bunker prices. Commencing the fourth quarter of 2017 and during Q1 2018, freight rates have decreased while bunker prices continued to increase.”

Despite these conditions, Zim said it continued to be one of the top performers in the industry. EBITDA in Q1 amounted to $20.7 million compared to $51.3 million in Q1 2017. Adjusted EBITDA was $25.6 million compared to $57.4 million last year.

EBIT was negative $7.1 million compared to EBIT of $24.6 million in Q1 2017. Negative adjusted EBIT was $2.2 million, compared to adjusted EBIT of $30.7 million the previous year.