-

The Small Business Corporation and Alliance of Concerned Truck Owners and Associations signed an agreement that gives ACTOO members access to zero-interest, collateral-free loans

-

About P1.8 billion will be made available to micro, small, and medium enterprises–including truckers–through the Bayanihan COVID-19 Assistance to Restart Enterprises financing program

-

Loanable amounts fall into three tiers—micro, small, and medium—classified by asset size

-

A one-time service fee will be charged upfront to cover processing cost

-

ACTOO vice president Venarica Papa encouraged members to take advantage of the initiative, a first for the industry

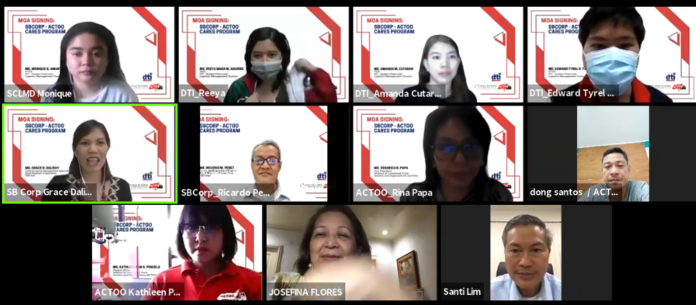

The Small Business (SB) Corporation and Alliance of Concerned Truck Owners and Associations (ACTOO) on June 29 signed a memorandum of agreement giving ACTOO members access to zero-interest, collateral-free loans amounting to about P1.8 billion.

Qualified ACTOO members may–along with other micro, small, and medium enterprises from other industries–avail of the loan through Bayanihan COVID-19 Assistance to Restart Enterprises (CARES), a financing program that aims to assist MSMEs recover from adverse effects of the COVID-19 pandemic. The loan program is in compliance with Republic Act No. 11494 or Bayanihan 2, which mandated SB Corp. to expand its existing loan programs.

SB Corp. executive vice president and chief operating officer Santiago Lim, during the virtual signing, said “the transport and logistics sector has been both adversely affected by the pandemic and at the same time is in a position to recalibrate and be a significant contributor to the economic recovery of the country.”

“We believe that this partnership is a welcome initiative that came as a great relief given the impact of the pandemic on the sector,” Lim added.

Approval of loans will be on a first-come, first-served basis. Lim said around P300 million out of the P4-billion allocation for non-tourism MSMEs may be used for ACTOO members’ loans. He added that Tourism Secretary Bernadette Puyat agreed to SB Corp.’s request to lend P1.5 billion from the P3.8 billion allotted for tourism MSME loans since tourism sector applications are slow.

Lim encouraged ACTOO members to apply immediately since CARES does not only cater to the trucking sector. Over the past four months, P500 million loans were processed under CARES per month on average, which means that if the trend continues, the P1.5 billion additional fund may last only until September.

Even if Bayanihan 2 is not extended by Congress when it expires on June 30, Lim said this will not affect funds under the CARES program since these have already been downloaded to SB Corp. as part of the financial institution’s equity fund.

ACTOO vice president Venarica Papa welcomed the development and encouraged members to take advantage of the initiative, which she noted is a first for the industry.

The loanable amounts under the CARES program have three tiers—micro, small, and medium—classified by asset size:

- Micro with an asset size of P3 million and below – up to P300,000 loanable amount

- Small with an asset size of more than P3 million to P15 million – up to P1 million

- Medium with an asset size of above P15 million to P100 million – up to P5 million

While the loan is interest free, a one-time upfront service fee will be charged to cover SB Corp.’s processing cost.

The program allows a six-month to one-year grace period, extendable for up to three years or a total of four years. The service fee will depend on loan terms: 1% for the one-year grace period, 6% for the two-year grace period, and 8% for the four-year grace period.

Asked if truckers still awaiting their certificate of public convenience (CPC) from the Land Transportation Franchising and Regulatory Board may apply for the loan, Lim said priority will be given to those who have complied with documentary requirements. SB Corp., however, said it will look at how it can accommodate as many truckers as possible.

Papa noted the agreement will be continuously studied and re-assessed, and adjustments made, including in the requirements, as per the MOA.

But for now, Papa said priority will be given to truckers with CPCs as well as to those operating not-for-hire trucks that do not require a CPC.

SB Corp. will conduct webinars to walk ACTOO members through the qualifications, documentary requirements, and procedures for loan availment. – Roumina Pablo