-

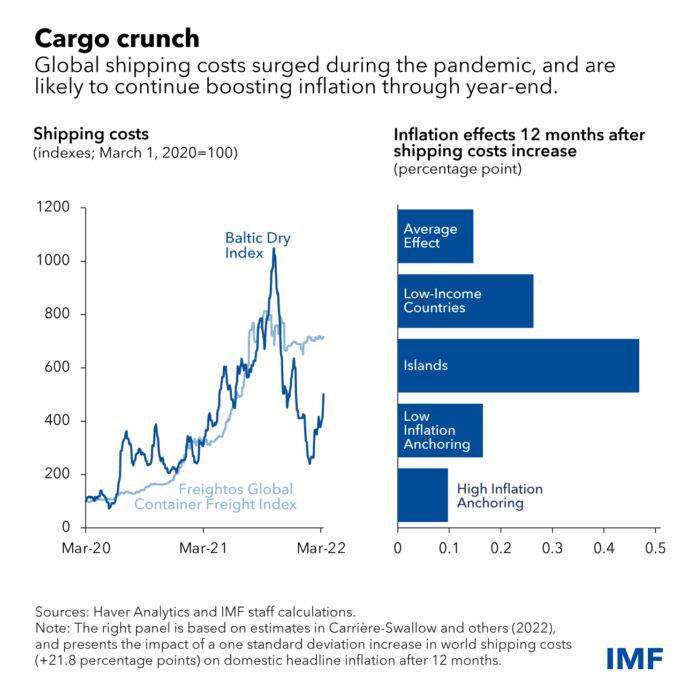

Skyrocketing shipping rates are expected to drive up consumer price inflation for the rest of 2022, according to IMF staff

-

Strong, credible monetary policy framework with well-anchored expectations can mitigate the impact of soaring shipping costs on consumer prices

-

The increase in shipping costs in 2021 could raise inflation by about 1.5 percentage points in 2022

The shock from the two-year-old coronavirus pandemic as it plays havoc on global supply chains has sent shipping rates soaring in recent weeks, driving up consumer price inflation that will be felt for the rest of 2022, International Monetary Fund staff said in a weekly forum.

Combining their views in an article on March 28 on IMFBlog, “How Soaring Shipping Costs Raise Prices Around the World,” authors Yan Carrière-Swallow, Pragyan Deb, Davide Furceri, Daniel Jiménez and Jonathan D. Ostry said the greatest impact will be felt by countries that rely more on imports and those that typically pay higher freight costs.

They said a strong and credible monetary policy framework with well-anchored policy expectations can mitigate the impact of soaring shipping costs on consumer prices.

“The shock of the pandemic underscored just how crucial the maritime container trade is to the global economy,” the analysts said, noting that more than 80% of the world’s traded goods are seaborne, most of them shipped in 40-foot containers.

They said from Shanghai to Rotterdam to Los Angeles, COVID-19 upended supply chains as ports were undermanned, truck drivers and ship crews couldn’t cross borders due to public health restrictions, and pent-up demand from huge stimulus programs during extended lockdowns overwhelmed the capacity of supply chains.

These factors caused delays in getting goods to customers, and drove up the cost of transporting them.

“The result of those challenges was that the cost of shipping a container on the world’s transoceanic trade routes increased seven-fold in the 18 months following March 2020, while the cost of shipping bulk commodities spiked even more,” the staff said.

“Our new research shows that the inflationary impact of those higher costs is poised to keep building through the end of this year. Our analysis predates the war in Ukraine but isn’t isolated from it: the conflict will likely exacerbate global inflation,” they warned.

The authors said they studied data from 143 countries over the past 30 years and found that shipping costs were an important driver of inflation around the world.

“When freight rates double, inflation picks up by about 0.7 percentage point. Most importantly, the effects are quite persistent, peaking after a year and lasting up to 18 months. This implies that the increase in shipping costs observed in 2021 could increase inflation by about 1.5 percentage points in 2022,” they said.

While the pass-through to inflation is less than that associated with fuel or food prices – which make up a larger share of consumer purchases – shipping costs are much more volatile. Hence, the contribution in the variation of inflation due to global shipping price changes is quantitatively similar to the variation generated by shocks to global oil and food prices, the staff said.

They discovered some of the mechanisms at work: that higher shipping costs hit prices of imported goods at the dock within two months, and quickly pass through to producer prices, many of whom rely on imported inputs to manufacture their goods.

But the impact on the prices consumers pay at the cash register builds up more gradually, hitting its peak after 12 months, they said.

“Our results suggest the inflationary impact of shipping costs will continue to build through the end of 2022. This will create complicated trade-offs for many central bankers facing increasing inflation and still ample slack in economic activity. Moreover, the war in Ukraine is likely to cause further disruptions to supply chains, which could keep global shipping costs – and their inflationary effects – higher for longer,” they said.