The Philippines needs to look at non-traditional export destinations and products to widen its market base as the weak global economy continues to pull down the country’s merchandise exports.

The Philippines needs to look at non-traditional export destinations and products to widen its market base as the weak global economy continues to pull down the country’s merchandise exports.

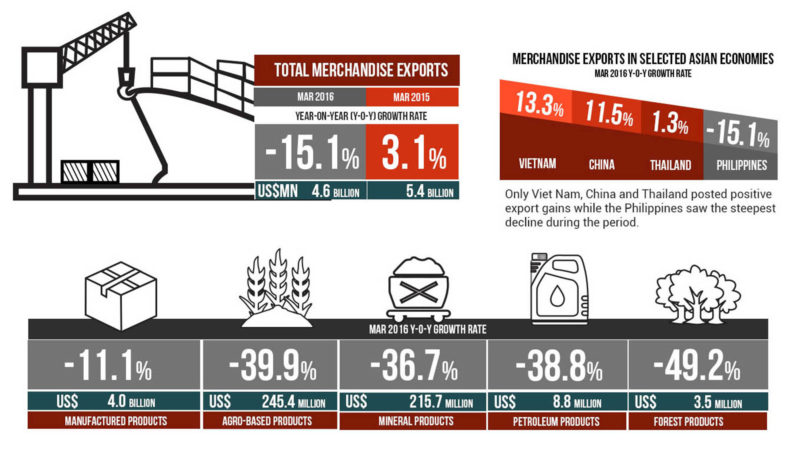

Total export earnings declined 15.1% in March 2016 to US$4.6 billion from $5.4 billion in the same month last year due to lower sales receipts from all commodity groups, the Philippine Statistics Authority reported. This is the 12th consecutive month exports have slipped.

“It’s a necessary step in the midst of a challenging global economy. The country’s traditional trade partners continue to post subdued growth, global trade is not expected to pick up soon, and China’s slowdown is impinging upon overall growth in emerging economies,” Socioeconomic Planning Secretary Emmanuel F. Esguerra said in a statement.

Among 11 selected Asian economies, only Vietnam, China, and Thailand posted export gains, while the Philippines saw the steepest decline during the period. Lower revenues from several major trading partners also dragged Philippine exports in March 2016.

“To be able to reach out to other potential export markets and sell our products, it is crucial to ease government regulation and strengthen market intelligence gathering in partnership with the private sector. We also need to maximize the opportunities in trade agreements and economic groupings particularly within the ASEAN region,” the Cabinet official said.

For the first quarter of 2016, exports amounted to $13.1 billion, 8.4% lower than the $14.3 billion registered last year.

“Given the growth of merchandise exports in the first quarter, the Philippines needs to grow by at least 8.3 percent in the next three quarters to attain the low-end projection of the Export Development Council of 5.4 percent in 2016,” said Esguerra, who is also National Economic and Development Authority director-general.

In March 2016, total earnings from manufactured products dropped 11.1% to $4 billion from $4.5 billion year-on-year.

“This is a reflection of a general slowdown in the global manufacturing sector. On the upside, wood manufactures, and iron and steel posted positive growth rates in March 2016. Electronic exports also reached its tenth consecutive month of positive growth during the period,” Esguerra said.

In the short to medium term, he added, it is important to promote industry and national competitiveness by crafting policies that will move domestic industries into higher-value niches in the global value chain (GVC), and induce multinational enterprises, which are lead firms in the GVCs, to locate in the country.

Japan remained the country’s top export destination in March with a 21.5% share, followed by the U.S., which accounted for 14.6%, and Hong Kong with 12.5%.

Image courtesy of khunaspix at FreeDigitalPhotos.net