Among the 17 East Asia and Pacific economies covered, 13 have increased their overall competitiveness—albeit marginally—with Indonesia, Brunei Darussalam, and Vietnam making the largest strides since last year, according to The Global Competitiveness Report 2017-2018 published on September 26 by the World Economic Forum.

Among the 17 East Asia and Pacific economies covered, 13 have increased their overall competitiveness—albeit marginally—with Indonesia, Brunei Darussalam, and Vietnam making the largest strides since last year, according to The Global Competitiveness Report 2017-2018 published on September 26 by the World Economic Forum.

“Only Singapore, the Philippines, Cambodia, and Lao PDR have seen their scores decrease. Even with China’s gradual slowdown, economic growth has continued to be robust in the region as a result of sustained domestic demand and increased exports from emerging economies,” said the report.

Singapore, the most competitive economy in the region, slipped from second to third place in overall global standing, while Hong Kong advanced from ninth to sixth place—passing Japan, now ranked ninth.

The lowest ranked performer among the region’s advanced economies continues to be the Republic of Korea, which remains 26th for a fourth consecutive year, placing it behind Malaysia (23rd), the region’s top emerging economy, and just ahead of China (27th).

Many of the region’s advanced economies—including Korea, Hong Kong, and Taiwan, but not Japan—and a few emerging economies have benefited from a favorable macroeconomic context.

This could be partly explained by a regional financial market stabilizing after the volatility of late 2016, although the recent escalation of tensions in the Korean peninsula has again raised uncertainty. High levels of household debt in many advanced economies may also eventually threaten the region’s economic and financial stability.

There have been signs of a productivity slowdown among the region’s advanced economies and in China, suggesting the need for greater focus on advancing technological readiness and promoting innovation.

Hong Kong is the region’s only economy among the top 10 globally in technological readiness, a category dominated by European economies—but all the others, except Singapore, have made tremendous progress since last year.

On innovation, Taiwan rebounds this year after several years of decline, Hong Kong and New Zealand continue to make steady progress, and Korea’s score improves slightly. Both Japan and Singapore maintain their places among the top 10 innovators, despite their scores falling this year—Japan’s for the third consecutive year.

Innovation and sophistication are not the only priorities, however: Vietnam, Cambodia, the Philippines, Lao PDR, and Mongolia could all make large gains in competitiveness at a relatively lower cost by improving their performance on infrastructure, health, and education.

Among the members of the Association of Southeast Asian Nations (ASEAN), Singapore is followed by Malaysia, rising to 23rd spot from 25th previously. The others are Thailand, landing in no. 32 from no. 34; Indonesia in 36th place from 41st; Brunei Darussalam at no. 46 from no. 58 previously; Vietnam, now no. 55 from no. 60; Philippines, no. 56 from no. 57; Cambodia, placing 94th from 89th; and Lao PDR, in 98th place from 93rd.

Overall, Switzerland is the world’s most competitive economy for the ninth consecutive year, narrowly ahead of the United States and Singapore, according to the report’s Global Competitiveness Index (GCI).

Others making up the top 10 include the Netherlands in fourth place and Germany in fifth. Hong Kong jumps three places to sixth, edging out Sweden (7), UK (8), and Japan (9), all of which decline one place. Finland is holding stable in 10th position.

The Global Competitiveness Report ranking is based on the GCI, which was introduced by the World Economic Forum in 2005. GCI scores are calculated by drawing together country-level data covering 12 categories—the pillars of competitiveness—that collectively make up a comprehensive picture of a country’s competitiveness.

The 12 pillars are institutions, infrastructure, macroeconomic environment, health and primary education, higher education and training, goods market efficiency, labor market efficiency, financial market development, technological readiness, market size, business sophistication, and innovation.

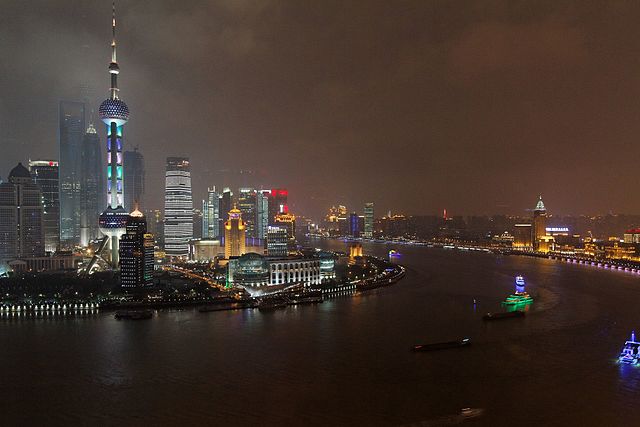

Photo: KimonBerlin