Philippine-based port operator International Container Terminal Services, Inc (ICTSI) is making a follow-on bond offering to finance port projects not only in the Philippines but overseas.

In a disclosure to the Philippine Stock Exchange, ICTSI said the offering of between $100 million and $150 million will finance greenfield projects as well as potential acquisitions and other corporate projects.

ICTSI said it will reissue the outstanding subordinated bond issue of $200 million issued in May 2011 to increase the issue size.

ICTSI added the final terms and conditions of the offering, including the amount, interest and maturity date will be determined by the board of directors.

The board already approved the issuance by Royal Capital BV, a subsidiary of ICTSI, of further subordinated perpetual capital securities to be consolidated and form a single series with the $200-million subordinated guaranteed perpetual capital securities issued on May 5, 2011.

ICTSI has tapped Hong Kong and Shanghai Banking Corp Limited and Citigroup Global Markets Limited as joint lead managers.

ICTSI drew a strong response to its perpetual non-call five-year bond at the end of April, receiving orders in excess of $800 million for the $200-million deal.

ICTSI priced the bond on April 28 to yield 8.375%, lower than the guidance of 8.5%.

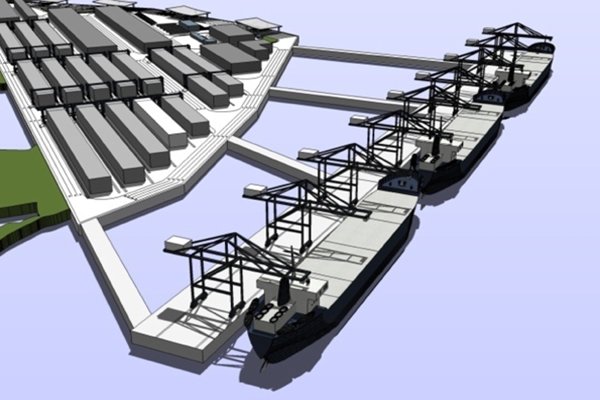

ICTSI currently has three ongoing port projects overseas — in Mexico scheduled to be completed by 2014, in Argentina for completion by next year, and in Colombia. Each has a project cost of $250 million.