-

Further consolidation within the automotive sector seen as smaller vehicle makers struggle to survive

-

The auto industry could become more exposed to intercontinental transport, as local facilities are reduced and operations are focused on fewer, larger plants

-

With large new battery production facilities being built worldwide for electric vehicles, major component sourcing will be much more geographically extensive than it is at present

The automotive sector is currently undergoing an extraordinary transformation that will have profound implications for logistics services, according to a Transport Intelligence (Ti) forecast.

The collapse in global sales in 2020 and a shift in technology have thrust the automotive sector into crisis, the whitepaper on supply chain trends for 2021 said.

Of the 16 traditional internal combustion engine (ICE) vehicle manufacturers (VMs), a large proportion is facing significant financial pressure. Smaller VMs are struggling to survive and this is very likely to spur further consolidation within the sector, of which the merger of Peugeot-Citroen and FCA is a good example, said the report.

The outcome of this consolidation is expected to be fast and transformative, namely:

- Consolidation of engine plants and of assembly plants, with a focus on larger plants

- Reduction in the number of component suppliers due to the merger of plants

- Reduction in the variety of ICE models produced

These changes will have deep ramifications for logistics provision. The automotive sector has been a substantial market for the logistics sector and this will change, said the whitepaper released this month.

- The automotive industry is likely to become more exposed to intercontinental transport, as local facilities are reduced in number and operations are focused on fewer, larger plants

- Investment in assembly plants is likely to fall, resulting in fewer, smaller contracts

Where demand will be increasing is in electric vehicle (EV) related production.

“The shift from automotive manufacturers utilising mechanical engineering to electrical and electronic engineering will have profound effects on the architecture of the supply chain and on the nature of logistics demand,” Ti said.

The supply chain geography of EV and associated technology is distinctly different from that of mechanical engineering. With large new battery production facilities being built across the world, major component sourcing will likely be much more geographically extensive than that of the present mechanical ICE supply chain.

A further change has also taken place over the past couple of years. A number of large vehicle manufacturers have collaborated with cloud computer service providers, i.e. Amazon and Microsoft, to provide the information architecture not only of the supply chain but also the operational systems of their assembly plants.

“This represents a profound change in VMs’ ‘logistics posture’, essentially outsourcing a key aspect of production. This complements an increasing level of automation in areas such as line-feed and inbound logistics in assembly plants,” the report said.

The implications of these changes for the logistics markets will include:

- Significant stress on the contract logistics sector

- A shift in emphasis to technology-led solutions rather than physical assets

- An increase in demand from the automotive sector for container shipping

- Increasingly commodified services as much of the supply chain merges with electronics

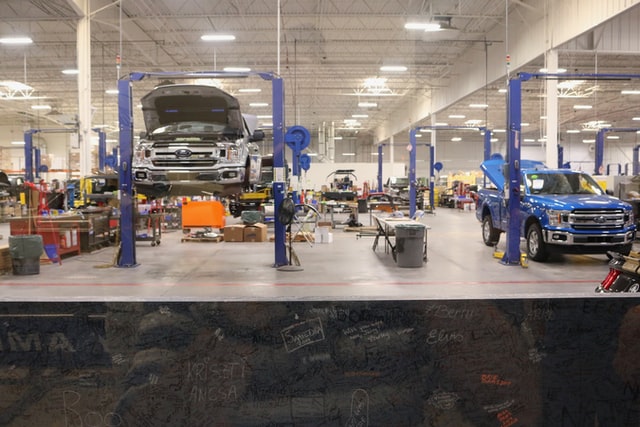

Photo by Laurel and Michael Evans on Unsplash