-

China port congestion remains high with extended lockdowns

-

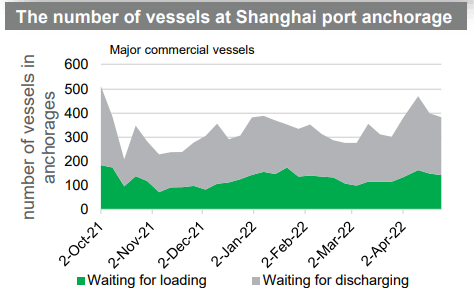

Total congestion level at Shanghai ports jumped by about 30-40% as of April 25 since the start of March 2022

-

Vessel capacity arrivals into Chinese ports to load or discharge cargo dropped by 11% in the first quarter from the same period last year

-

Freight rates for containers and small bulkers have been softening with mainland China exporting less container-related cargo with lockdown measures

Port congestion rebounded in northern Chinese ports as COVID-19 lockdown measures were extended from Shanghai to more Chinese cities, including parts of Beijing, according to S&P Global Market Intelligence.

“Many vessels are trying to find alternative ports since social restrictions in major cities in east China including Shanghai are expected to continue into early May. This will likely increase congestion in southern ports as well,” S&P Global said.

Total congestion level at Shanghai ports jumped by about 30-40% as of April 25 since the start of March 2022, although this is still lower than the peak of last year over the third quarter, according to Commodities at Sea, S&P Global Market Intelligence.

Chinese import and export growth has been reduced from year-ago level since the lockdowns and labor shortage affected manufacturing sector in mainland China.

According to S&P Global Market intelligence AIS data, vessel capacity arrivals into Chinese ports to load or discharge cargo dropped by 11% to about 1.15 billion deadweight in the first quarter of 2022 from about 1.28 billion deadweight from first quarter of 2021.

READ: China lockdowns, Ukraine conflict spur greater supply chain disorder

Freight rates for containers and small bulkers have been softening with mainland China exporting less container-related cargo with lockdown measures, S&P said.

High demand for exports in mainland China, along with tight container capacity is affecting general bulk cargo flow. S&P said some general cargo typically shipped in a container box, including steel, aluminum, fertilizer and bagged cargo, are being shipped on general cargo ships and small geared bulk vessels.

In addition, lesser export volume from mainland China eased congestion on discharging ports, including US container ports.

But once COVID-19-related lockdown measures are lifted in mainland China along with seasonal recovery of shipments, port congestion may be a problem in the discharging port side over the coming peak season, S&P said.