-

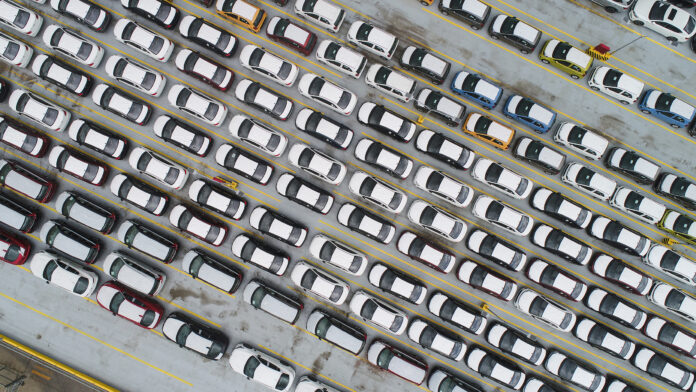

The Bureau of Customs will implement a Department of Trade and Industry order removing the temporary safeguard duty on imported passenger cars and light commercial vehicles

-

Under Customs Memorandum Order No. 28-2021, cash bonds collected on auto imports entered into or withdrawn from warehouses in the Philippines for consumption since February 1, 2021 must be returned to concerned importers

-

For processing of refunds, once ports order the return of the cash bonds, these should be transmitted to the Office of the Commissioner for review and confirmation along with other required documents

The Bureau of Customs (BOC) will implement a Department of Trade and Industry (DTI) order dismissing the imposition of temporary safeguard duty on imported passenger cars and light commercial vehicles.

The dismissal of the safeguard duty was recommended by the Tariff Commission (TC).

In Customs Memorandum Order (CMO) No. 28-2021, Customs commissioner Rey Leonardo Guerrero said that under DTI Department Administrative Order (DAO) No. 21-04, all cash bonds imposed and collected as provisional safeguard measure on shipments of passenger cars and light commercial vehicles entered into or withdrawn from warehouses in the Philippines for consumption since February 1, 2021 should be immediately returned to the concerned importers upon compliance with applicable customs laws and regulations.

READ: DTI scraps safeguard duty for auto imports

CMO 28-2021 dated August 18 took effect immediately.

The order stated that once the ports order or recommend the return of the cash bonds, these should be transmitted to the Office of the Commissioner for review and confirmation along with the following documents:

- Statement of Refund duly signed by the district collector

- Single administrative document/import entry and internal revenue declaration

- Proof of payment

- BOC official receipt processing fee

- Certificates of No Outstanding Obligation

- Recommendation/order from the port

- Endorsement to Financial Management Office (FMO)

- Certification from the FMO that the cash bond was deposited to a trust fund or to the account of BOC, whichever is applicable, and the details pertinent thereto

DAO 21-04 dated August 6 was issued after TC in its final report released on July 23 recommended that no general safeguard measure be imposed on the importation of completely built-up unit passenger cars and CBU light commercial vehicles.

TC said the decision took into consideration that the passenger cars and light commercial vehicles were not imported, whether absolute or relative to domestic production, in increased quantities during the period of investigation (POI) covering 2014 to 2020.

As such, TC said “the determination of serious injury or threat thereof, causation, and unforeseen developments has become moot and academic.”

TC started a formal investigation last February into the merits of imposing definitive safeguard duty on importations of passenger cars and light commercial vehicles from various countries on the request of DTI.

In the same month BOC, on DTI’s order, issued CMO 06-2021 imposing provisional safeguard duties in the form of a cash bond amounting to P70,000 per unit for imported passenger cars and P110,000 per unit for imported light commercial vehicles. The CMO was released after DTI’s preliminary investigation showed that increased importation of these vehicles was causing serious injury to the domestic motor vehicle manufacturing industry.

DTI undertook the preliminary determination for safeguard measures upon a petition filed in 2019 by the Philippine Metalworkers Alliance. The group is a national union of automotive, iron and steel, electronics, and electrical sectors, including affiliates composed of key players in the automotive industry.

Under Republic Act No. 8800, or the Safeguard Measures Act, any person, whether natural or juridical, belonging to or representing a domestic industry may file with the DTI secretary a verified petition requesting action to remedy the serious injury to the domestic industry caused by increased imports of a like or directly substitutable product.

DTI’s preliminary determination also found that critical circumstances existed where delay in imposing the measure would cause the industry possible irreparable damage.

Overall, DTI said, the domestic industry suffered declining market shares, sales, and employment even as inventories accumulated. It also sustained increasing losses over the period, affecting its cash flows and ability to invest. It also had to contend with excess and increasing production capacity in countries such as Thailand, Indonesia, and China.