-

The Convention on Temporary Admission, also known as the ATA Carnet System, is set to take effect in the Philippines on April 17, 2022

-

ATA Carnet is an international scheme that allows the duty-free and tax-free importation of goods for up to one year

-

It cuts red tape by simplifying and unifying customs border crossing regulations for temporary import and export

- Philippine businesses attending trade fairs and exhibitions in territories parties to the Convention are among those expected to benefit from the system

-

The Instrument of Accession to the World Customs Organization was deposited on Jan 17 by Philippine Ambassador to Belgium, Luxembourg, and the European Union Eduardo José A. de Vega

-

It was accepted by WCO Secretary General Kunio Mikuriya

-

The country is set to become the 73rd contracting party to the Convention

The Convention on Temporary Admission, also known as the ATA Carnet System, is set to take effect in the Philippines on April 17, 2022, paving the way for the duty-free and tax-free importation of goods for up to one year.

The development follows the deposit of the Instrument of Accession on January 17 by Philippine Ambassador to Belgium, Luxembourg, and the European Union Eduardo José A. de Vega and accepted by World Customs Organization Secretary General Kunio Mikuriya at the WCO headquarters in Brussels, Belgium.

The Philippines is set to become the 73rd contracting party to the Convention.

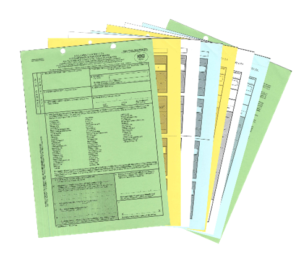

The ATA Carnet is an international customs document that contains pre-prepared unified customs declaration forms to be used at each customs border offices and serves as a guarantee to customs duties and taxes, according to the International Chamber of Commerce (ICC).

Sometimes referred to as the “passport for goods,” ATA is an acronym of the French and English words “admission temporaire/temporary admission,” while carnets are referred to as “passports for goods” or “merchandise passports”.

Philippine businesses attending trade fairs and exhibitions in territories that are parties to the Convention are among those expected to benefit from the Convention.

The deposit of the Instrument of Accession follows the Senate’s concurrence in November 2021 with the accession to the Convention on Temporary Admission and its various Annexes, which constitute the international codification of the ATA Carnet system.

The Senate’s concurrence came after President Rodrigo Duterte signed the Convention on April 28, 2021.

Senate Committee on Foreign Affairs chairman and Senator Aquilino Pimentel III earlier said the treaty would be advantageous to the Philippines because it would increase the efficiency and productivity of the Bureau of Customs (BOC).

With the codified ATA Carnet system, Pimentel said BOC would no longer need to use valuable time and resources processing temporary admission of scientific, professional and other goods and equipment.

He said BOC would only need to rely on and monitor the ATA Carnets, which would also guarantee full payment of applicable duties and taxes should the temporarily admitted goods fail to be totally re-exported.

The Department of Trade and Industry earlier pointed out that the provisions of the ATA Carnet conform to the provisions of the World Trade Organization’s Trade Facilitation Agreement, and that its principles are already provided under Republic Act No. 10863 or the Customs Modernization and Tariff Act.

Trade facilitation tool

Established under the ATA Convention and the Istanbul Convention as a trade facilitation tool, ATA Carnets cut red tape by simplifying and unifying customs border crossing regulations for temporary import and export, according to the ICC.

The Chamber said that with the ATA Carnet, exhibitors, salesmen, artists, athletes, TV crews, technicians, event participants and business travellers may:

- travel through customs without paying import duties, taxes at each customs border office

- use one unified document for all declarations at home and abroad

- use one document for multiple destinations and trips throughout its one-year validity

- make advanced customs arrangements at predetermined costs

ICC said ATA Carnets cover almost everything, as defined in 11 annexes to the Istanbul Convention. ATA Carnets are mainly issued to cover:

- goods for use at trade fairs, shows, exhibitions

- professional equipment

- commercial samples

- personal effects and goods for sports purposes

– Roumina Pablo