Air cargo traffic has continued to gather strength in 2014, and is forecast to sustain its momentum over the next two decades amid positive views on global economic and trade growth, says the World Air Cargo Forecast, the biennial long-term industry overview of the Boeing Company.

Air cargo traffic has continued to gather strength in 2014, and is forecast to sustain its momentum over the next two decades amid positive views on global economic and trade growth, says the World Air Cargo Forecast, the biennial long-term industry overview of the Boeing Company.

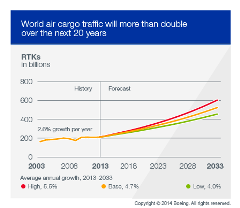

Over the next 20 years, world air cargo traffic is expected to grow an average of 4.7 percent per year to more than double the revenue tonne-kilometers (RTK) logged in 2013, says the report.

Airfreight, including express traffic, will average 4.8 percent annual growth, measured in RTKs. Airmail traffic will grow much more slowly, averaging 1 percent annual growth through 2033.

Overall, world air cargo traffic will increase from 207.8 billion RTKs in 2013 to 521.8 billion in 2033.

The forecast takes into account predictions of economic growth, as measured by gross domestic product. GDP is forecast to rise 3.2 percent over the next 20 years, which will help drive cargo traffic to grow 4.7 percent annually.

The upbeat outlook comes after two years of either flat or slightly negative traffic growth, said Boeing. After rebounding more than 19 percent in 2010 over the depressed levels of 2009, world air cargo traffic stagnated from mid-2011 to early 2013. This prolonged period of weak growth can be attributed to two factors: a weak world economy and slack trade growth.

World air cargo traffic began to grow again in second quarter 2013 and ended the year with a 0.9 percent expansion above the 2012 traffic total.

Asia will continue to lead the world in average annual air cargo growth, with domestic China and intra-Asia markets expanding 6.7 percent and 6.5 percent per year, respectively. The Asia-North America and Europe-Asia markets will grow slightly faster than the world average growth rate.

Latin America markets with North America and with Europe will grow at about the world average growth rate, as will Middle East markets with Europe. Established markets grow more slowly than developing markets, so North America and Europe air cargo growth rates are below the world average rate.

Boeing also predicts the number of airplanes in the freighter fleet to increase by more than half at the end of the forecast period.

“We forecast long-term demand for 36,770 new airplanes, valued at $5.2 trillion. We project that 15,500 of these airplanes (42 percent of all new deliveries) will replace older, less efficient airplanes. The remaining 21,270 airplanes will be for fleet growth, which stimulates expansion in emerging markets and development of innovative airline business models,” said the report.

Single-aisle airplanes continue to command the largest share of the market, said Boeing. About 25,680 new single-aisle airplanes will be needed over the next 20 years. Fast-growing low-cost carriers and network carriers pressed to replace aging airplanes drive single-aisle demand.

The widebody fleet will need 8,600 new airplanes. The new generation of efficient widebody airplanes is helping airlines open new markets that would not have been economically viable in the past, said the report.

Photo courtesy of Boeing