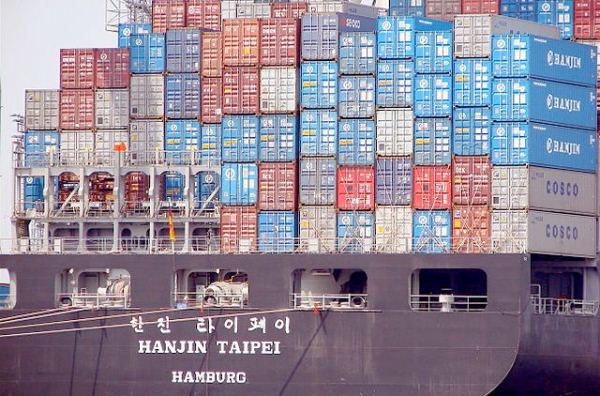

South Korea’s SM Shipping, the newest container carrier which was created by Samra Midas (SM) Group following its purchase of the Asia-North America route of defunct Hanjin Shipping, may not be able to launch as planned in March because it does not have enough containers.

South Korea’s SM Shipping, the newest container carrier which was created by Samra Midas (SM) Group following its purchase of the Asia-North America route of defunct Hanjin Shipping, may not be able to launch as planned in March because it does not have enough containers.

The newly formed shipping line is reportedly having problems acquiring the 90,000 containers it needs for its fleet of 12 box ships to provide cargo shipping services on the Far East-US trade route and other secondary loops by March.

This as most of Hanjin Shipping’s containers have been corralled by ship owners and authorities abroad after it went belly-up in late August. The debt-ridden former national carrier, which used to be the world’s seventh largest, had more than half a million containers before it sought and was granted court protection from its creditors in September last year.

Sources said SM Shipping may not be able to realize its shipping service plans in March as it would take about three to five months to build containers.

But SM Shipping is said to be looking at securing second-hand boxes in order to push through with operations on the key East-West trade lane as planned, before gradually expanding to other lanes.

Construction firm SM Group officially launched SM Shipping in ceremonies January 6 at a former Hanjin Shipping office in Seoul.

More acquisitions planned

Meanwhile, after buying Hanjin Shipping’s Asia-US operation in November, SM Group is set to take over its container terminals in South Korea.

It announced recently that SM Shipping clinched a pact with the Seoul court overseeing the receivership of Hanjin to purchase the collapsed firm’s 100% stake in Gwangyang Terminal and 85.45% stake in Gyeongin Terminal. The deal is expected to be formalized within the month.

The conglomerate is also considering the takeover of Hanjin’s Busan New Port Terminal.

SM Shipping might also link up with Hyundai Merchant Marine and feeder lines Sinokor Merchant Marine and Heung-a Shipping to create a small-scale vessel-sharing alliance.

Photo: Photocapy