The Association of Southeast Asian Nations (Asean) region holds good prospects for attracting investments, with a significant share of businesses considering the attractiveness of Asean as a whole when planning to invest in the region.

The Association of Southeast Asian Nations (Asean) region holds good prospects for attracting investments, with a significant share of businesses considering the attractiveness of Asean as a whole when planning to invest in the region.

Businesses also attach relatively high importance to Asean measures to achieve an Asean Economic Community (AEC) by 2015, but are relatively less satisfied with the group’s effectiveness with their implementation.

These are the key findings from the “2011-12 ASEAN-BAC [Business Advisory Council] Survey on ASEAN Competitiveness,” released on April 5.

The 2011-12 survey, the second such poll carried out on the Asean region, collated 405 responses from various firms that varied in size, age, ownership, and industry in all 10 Asean member-states.

Here are the major findings:

- Businesses continue to view the Asean region’s competitiveness for investments favorably. Eighty-eight percent of businesses plan to invest or increase investments in at least one Asean country over a three-year horizon (2011/12-2013/14).

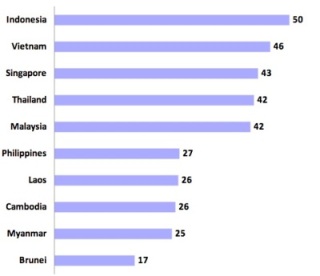

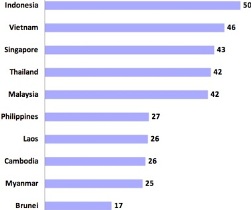

- The top investment destination is Indonesia, followed by Vietnam, Singapore, Thailand, Malaysia, and the Philippines.

- Of all respondents, 36.5 percent indicate that Asean countries offer the best prospects worldwide for their organizations’ offshore direct investments over the next three years.

- Asean’s attractiveness is also rated higher than China’s both as a market for goods and services and as a production location.

- Two-fifths of businesses consider the investment attractiveness of Asean as a whole when planning their investments in Asean countries over the next three years.

“This finding might point to a rising consciousness among businesses of Asean’s initiatives to create an AEC and of the opportunities that a more integrated Asean might bring,” noted Dr. Marn-Heong Wong and Andre Wirjo of the LKY School, authors of the survey report.

More key results:

- Implementation of the AEC blueprint across 14 policy areas is rated by businesses to be of relatively high importance to enhancing trade and investments in Asean.

- Businesses express below-average to above-average satisfaction with Asean’s implementation of measures across the areas.

- Least satisfactory are those related to increasing foreign equity participation in services sectors, consulting with businesses, developing and implementing mutual recognition of professional qualifications, developing or enhancing national competition policies, and disseminating information.

- The gap between importance and satisfaction level is widest in the areas of investment protection, simplification of customs procedures, and enhancing the transparency of non-tariff barriers.

From these findings, the Asean-BAC recommends forging closer economic integration to entice more businesses to plan their investments in Asean countries.

“Asean needs to not only ensure the continuous effective implementation of measures towards an AEC but also raise awareness among businesses of the measures being undertaken so that they can better exploit the opportunities that arise,” it added.

The Asean-BAC also urges the Asean region to strengthen its implementation of areas of the AEC blueprint that garnered the least satisfaction or showed the widest gaps between importance and satisfaction levels.

Map illustration: Jeff McNeill