The Bureau of Customs (BOC) has released revised uniform rates that will be charged by off-dock container yard/container freight stations (OCCs) starting January 1, 2016.

The Bureau of Customs (BOC) has released revised uniform rates that will be charged by off-dock container yard/container freight stations (OCCs) starting January 1, 2016.

Embodied in Customs Memorandum Order (CMO) No. 41-2015 dated December 1, the new rates have long been coming, with the current ones based on CMO 24-2001 issued 14 years ago. Stakeholders have long pushed for an adjustment in charges, citing inflation and higher operating costs.

READ: Hike in PH off-dock storage rates justified: PortCalls survey

Moving forward, the new rates will be adjusted automatically in proportion to “rate of increase of the arrastre and wharfage promulgated by the Philippine Ports Authority,” according to CMO 41-2015.

Customs commissioner Alberto Lina acknowledged the bureau has been “receiving numerous written complaints of alleged overcharging by CY/CFS-OCZ (container yard/container freight stations outside customs zone) Operators in violation of the provisions provided under CMO 24-2001.”

The new rates are being promulgated following public consultation with stakeholders, Lina added, to “help level the playing field among the operators.”

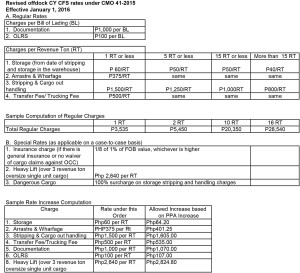

Under CMO 41-2015, OCC operators for consolidated import cargoes can charge a documentation fee of P1,000 per bill of lading (BL), 50% more than CMO 24-2001’s P500 rate. The fee for the Online Release System (OLRS) remains the same at P100 per BL.

Under CMO 41-2015, OCC operators for consolidated import cargoes can charge a documentation fee of P1,000 per bill of lading (BL), 50% more than CMO 24-2001’s P500 rate. The fee for the Online Release System (OLRS) remains the same at P100 per BL.

For storage (from date of stripping and storage in the warehouse), rates will be graduated: P60 per revenue ton (RT) for 1 RT or less, P50 per RT for 5RT or less, P50 per RT for 15RT or less, and P40 per RT for more than 15 RT.

BOC said rates based on RT shall be based on measurements/weights declared in the manifest/bill of lading unless a discrepancy in weight or measurement of more than 12% is officially reported to the customs agency by the CY/CFS operator and wharfinger. In such a case, the actual measurement or weight shall form the basis for applying the approved rates.

One RT is equal to 1 ton or 1 cubic meter, whichever is higher, according to the CMO. Cargo is rated as weight or measure and whichever produces the highest revenue will be considered the RT. Weights are based on metric tons and measures are based on cubic meter.

For arrestre and wharfage, the new rate is P375 per RT while transfer/trucking fee is P500 per RT.

For stripping and cargo out handling, rates will be P1,500 per RT for 1RT or less, P1,250 per RT for 5RT or less, P1,000 per RT for 15 RT or less, and P800 per RT for more than 15 RT.

The CMO included special rates applicable on a case-to-case basis. For the insurance charge (if there is general insurance or no waiver of cargo claims against CY/CFS operator), the rate is 1/8 of 1% of free-on-board value, whichever is higher.

The order said the “insurance charge will apply only if cargo owner/consignee presents a general and continuing waiver of cargo claims against the warehouse operator making the warehouse operator a co-insured party in the marine insurance.”

The new rate for heavy lift (over three RT oversize single unit cargo) is P2,640 per RT while the rate for dangerous cargo is 100% surcharge on storage stripping and handling charges.

The customs agency described dangerous cargo as articles posing risk to health, safety and property such as explosives, flammable, gas, flammable solids and liquids, liable to spontaneous combustions, substances which, when in contact with water, emit flammable gases, oxidizers, organic peroxides, toxic and infectious substances, radioactive material, corrosives, and similar substances. These cargoes shall specifically refer to articles listed in the Classification of Dangerous Goods by the Intergovernmental Maritime Consultative Organization or the appropriate government agency and/or the United Kingdom Carriage of Dangerous Goods in Ships, CMO 41-2015 said.

All charges are subject to value-added tax.

Meanwhile, BOC said the Association of Off-Dock CFS Operators of the Philippines (ACOP), any OCC, or importer or its authorized customs representative or broker, “may file a complaint supported by official receipt of payment which indicates a violation of this Order such as overcharging on the part of the OCC beyond the approved charges under this Order.”

The complaint should be filed with the Deputy Collector for Operation of the concerned Collection District pursuant to procedures provided under CMO 32-2015. This CMO covers revised rules and regulations for the establishment, supervision, and control of off dock CY/CFS and other off dock customs facilities outside customs zones.

A first offense under CMO 41-2015 carries a P300,000 penalty payable to the BOC. It also requires refunding the consignee in the amount equivalent to 100% of the overcharge within five days after a decision is rendered. Non-payment of the penalty and non-refund of the overcharge will cause the suspension of transfer of containers to the erring OCC operator until full payment and refund has been made.

A second offense will mean a penalty based on that imposed under the first offense plus a recommendation for immediate six-month suspension of transfer of containers to the erring OCC.

In addition to penalties under the first offense, a third offense allows the district collector to recommend revocation of the permit to operate against the erring OCC operator.

Asked for comment on the new CMO, ACOP president Alex Ong told PortCalls, “We have already informed our clients and are preparing to adjust our rates correspondingly for next year.” – Roumina Pablo